Shenzhen Energy, a Shenzhen-listed company, is evaluating a major investment in a solar and power storage project in the Democratic Republic of Congo (DRC). This initiative reflects the company’s growing interest in international renewable energy projects, particularly in Africa.

Financial Modelling for the Project 📊

The proposed development, located near a copper and cobalt mine in Lubumbashi, will require a robust financial model to ensure feasibility and optimize returns. Key components to consider include:

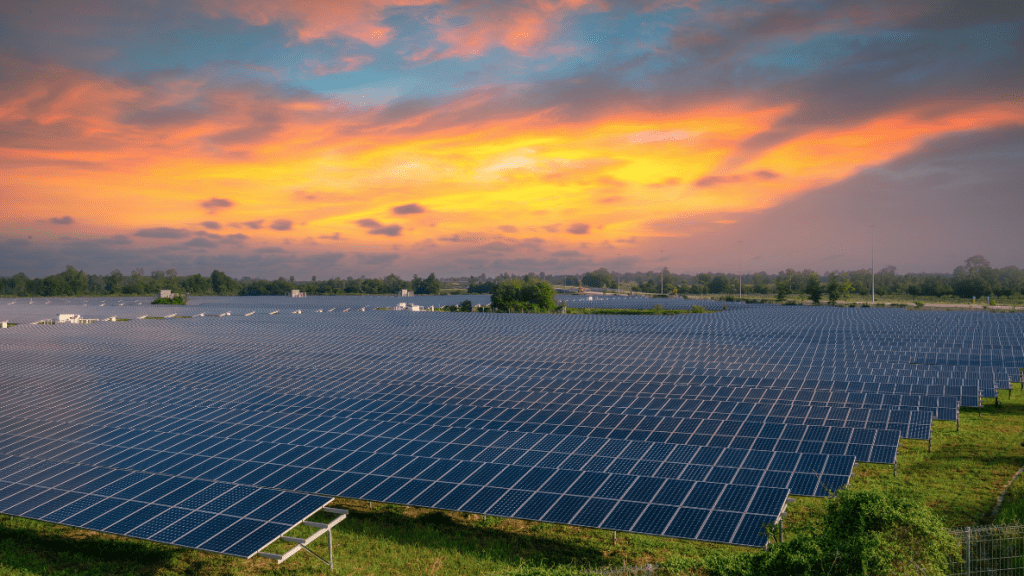

- 117 MW solar farm: Cost analysis of equipment, construction, and installation.

- 447 MWh power storage facility: Lifecycle costs, including maintenance and battery replacements.

- Microgrid network: Investment in grid stability and connection reliability.

Financial modelling for this project will also need to factor in revenue generation through the corporate power purchase agreement (PPA), which will ensure consistent cash flows by selling electricity directly to the mine’s operations.

The electricity generated will be sold directly to the mine’s operations through a corporate power purchase agreement (PPA). The mine’s refinery currently produces 36,000 tonnes of copper and 5,300 tonnes of cobalt products annually, making reliable and renewable energy crucial for its operations.

Shenzhen Energy’s Global Footprint 🌱

Shenzhen Energy has been actively expanding its portfolio beyond China, focusing on renewable energy investments:

- Ghana: The company owns 60% of the 560 MW Sunon Asogli Power project in partnership with the China Africa Development Fund.

- Vietnam: In 2021, it commissioned a 50 MW wind farm in Ninh Thuan province for an estimated USD 80 million.

- Global Installed Capacity: By the end of 2023, Shenzhen Energy’s installed capacity reached 19 GW, including:

- 6.3 GW of coal-fired power.

- 5.2 GW of gas-fired power.

- 3.7 GW of wind power.

- 1.8 GW of solar power.

- 1 GW of energy-from-waste projects.

Key Financial Considerations 🌍

- Revenue Streams: The corporate PPA guarantees long-term revenue, providing financial stability.

- Decarbonization Benefits: The project supports the mine in reducing operational costs associated with fossil fuels, while aligning with global sustainability goals.

- Risk Management: Addressing potential risks like currency fluctuations, regulatory changes, and operational challenges in the DRC.

- Investor Appeal: The project’s alignment with global renewable trends could attract additional funding and partnerships.

Looking Ahead 🚀

Shenzhen Energy’s move to explore renewable energy projects in the DRC highlights its ambition to diversify geographically while transitioning towards cleaner energy solutions. For those seeking tailored financial models and strategies for renewable energy projects, Finteam is here to help. Partner with us to drive your next solar, storage, or hybrid energy project towards success. Let’s shape the future of sustainable energy together! 🤝

🔍 Want to learn how Shenzhen Energy’s innovative approaches can shape your renewable energy investments? Partner with Finteam for expert insights and tailored financial strategies to make your next project a success. 📊👇