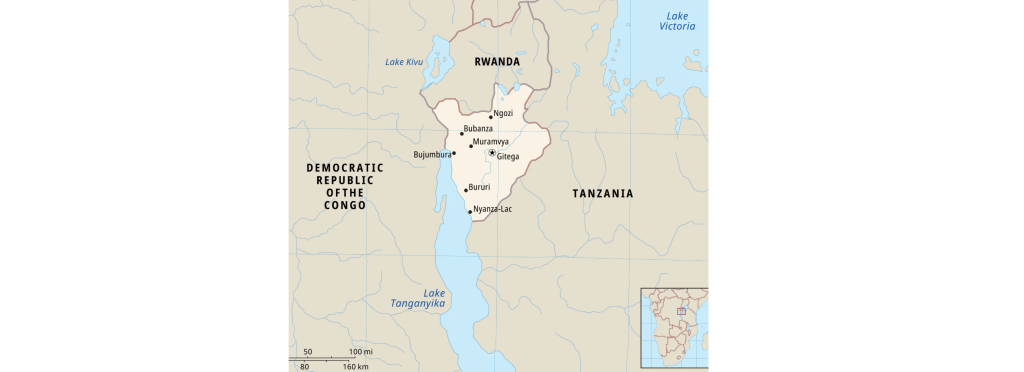

Anzana Electric Group has successfully closed USD 35 million in debt financing from the Eastern and Southern African Trade and Development Bank (TDB) for the construction of two hydropower projects in South Central Burundi. This milestone represents a transformative step in improving electricity access in a country where only 10% of the population has access to power.

Project Overview 📊

- Upper Ruvyironza SHP: 1.65 MW, operational by 2025.

- Upper Mulembwe SHP: 9 MW, operational by 2027.

- Total Capacity Addition: Over 10% increase in Burundi’s electricity generation capacity.

Key Partnerships & Risk Mitigation 🌱

To enhance the viability and bankability of the Songa Energy projects, Anzana and TDB have collaborated with key partners:

- African Trade & Investment Development Insurance (ATIDI): Providing political risk insurance and payment guarantees via the Regional Liquidity Support Facility (RLSF).

- Government of Burundi: Supporting policy and regulatory frameworks to accelerate electrification and ensure project success.

Why This Matters 🚀

This financing will have a profound impact on Burundi’s energy landscape:

- Expanding electricity access to over 100,000 households.

- Creating 500 jobs during peak construction.

- Driving knowledge transfer and enhancing local expertise in renewable energy projects.

Financial Modelling & Bankability

Hydropower projects require detailed financial modelling to ensure viability, particularly in emerging markets. Key considerations include:

- Cash Flow Forecasting: Estimating stable revenue streams from power purchase agreements (PPAs).

- Risk Assessment Models: Evaluating currency risks, policy shifts, and hydrological variability.

- Debt Structuring: Balancing loan tenors, interest rates, and repayment schedules for optimal financial sustainability.

Looking Ahead

The Songa Energy projects set a benchmark for independent power producers (IPPs) in Burundi, following the 2015 liberalization of the electricity sector. This initiative is expected to pave the way for more sustainable energy investments across the region.

🔍 Interested in financial modelling for renewable energy investments? Partner with Finteam for tailored financial strategies that maximize impact and bankability. Let’s build a greener future together!