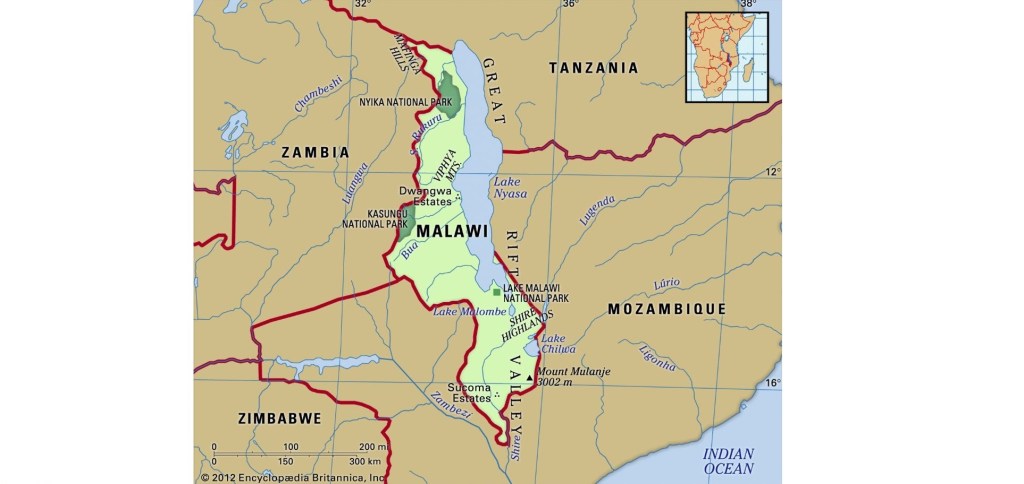

Old Mutual Alternative Investments Group (OMAI) has agreed to acquire a 25% stake in the 20 MWac Golomoti Solar Plant in Malawi from InfraCo Africa, marking a significant milestone in the country’s renewable energy sector. This move underscores the growing role of institutional investors in driving sustainable energy transitions across Africa.

Key Highlights of the Deal ☀️

✅ 25% stake acquisition by Old Mutual’s Infrastructure Investment Trust Fund (Malawi).

✅ Supports local participation in sustainable energy projects.

✅ 5 MW battery energy storage system (BESS) stabilizing Malawi’s national grid.

✅ Enhances investment in Malawi’s energy sector, reducing currency exchange risk.

✅ Strengthens Malawi’s renewable energy pipeline, reinforcing investment attractiveness.

Strategic Impact on Malawi’s Energy Landscape ⚡

Malawi’s energy sector faces challenges of low electrification rates and grid instability, with over 75% of the population lacking access to electricity. This deal aligns with Malawi 2063, the nation’s long-term vision for sustainable growth, and contributes to:

- Renewable Energy Expansion: Supporting Independent Power Producers (IPPs) to meet rising demand.

- Financial Stability: De-risking infrastructure investments attracts further private sector capital.

- Grid Reliability: BESS technology ensures stable power supply from renewable sources, improving energy security.

- Climate Goals: Reducing reliance on imported fossil fuels and cutting carbon emissions.

Economic & Social Impact Beyond Energy 🌍

Beyond clean energy, the Golomoti Solar Plant is transforming local communities through:

🔹 Access to Safe Drinking Water: Nine boreholes provide water to 2,000+ people.

🔹 Sustainable Agriculture: Agrivoltaics initiatives include chili farming, beekeeping, and sheep grazing under solar panels.

🔹 Infrastructure for Growth: Investments in education, healthcare, and grain storage bolster economic resilience.

🔹 Job Creation: Encouraging employment opportunities in renewable energy operations and maintenance.

Financial Modelling Considerations for Renewable Investors 📊

For investors evaluating renewable energy projects, financial modelling plays a key role in ensuring bankability and long-term returns. Key aspects include:

💰 Revenue Forecasting: Power Purchase Agreement (PPA) structures, tariff stability, and capacity payments.

💰 Cost Analysis: Capital expenditure (CapEx), operational expenditure (OpEx), and maintenance costs.

💰 Risk Assessment: Currency fluctuations, policy changes, and market deman.

💰 Debt Structuring: Financing mechanisms, interest rates, and debt-service coverage ratios (DSCR).

A Model for African Renewable Investment 🚀

This transaction exemplifies how public-private partnerships can unlock sustainable infrastructure development. Old Mutual’s investment in Golomoti Solar Plant demonstrates a scalable model for renewable energy growth across Africa. The deal not only reinforces investor confidence but also paves the way for further regional collaboration in clean energy expansion.

📊 Want to explore financial modelling strategies for renewable projects? Connect with Finteam for expert guidance on maximizing bankability and returns! 🌍⚡