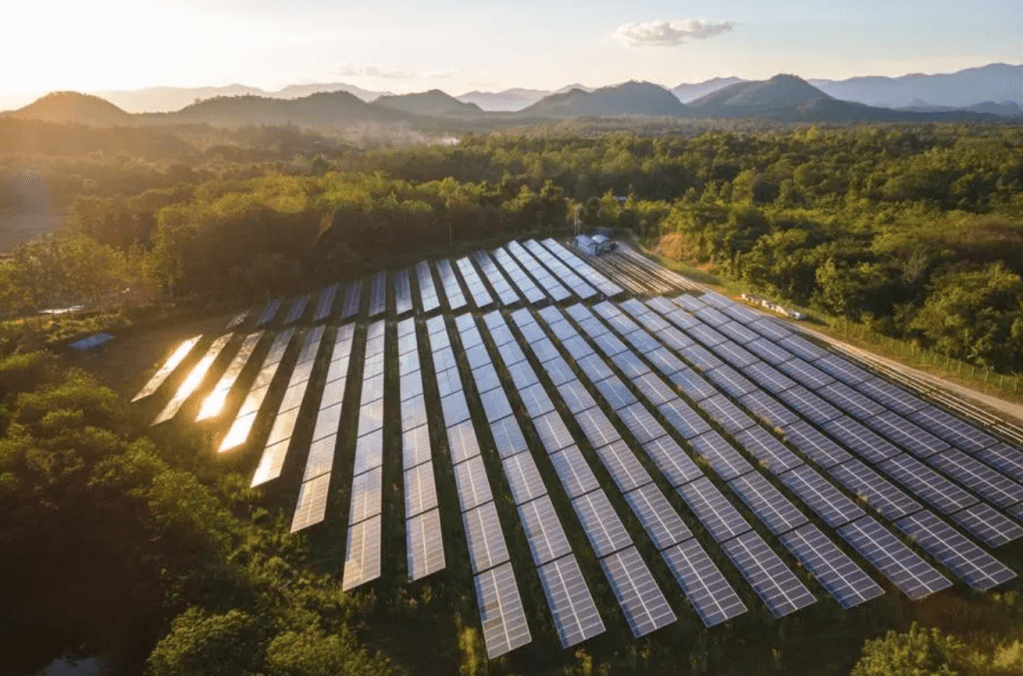

South Africa’s renewable energy sector has received a major boost with a ZAR 575 million (USD 31.5 million) investment from the Climate Investment Fund (CIF) and Nedbank into Pele Green Energy Group. This strategic investment aims to accelerate the country’s transition away from coal, enhance energy security, and reduce emissions at scale.

A Milestone Investment for Renewable Energy Growth 🌱

Pele Green Energy has been a key player in South Africa’s renewable energy sector since its founding in 2009. The company’s portfolio includes:

- 980 MW of operational solar and wind power projects.

- 670 MW under construction.

- A 5 GW+ development pipeline.

The new funding will enable Pele to expand its investments in key areas, including:

- Commercial & Industrial (C&I) renewable energy solutions, delivering clean power directly to businesses.

- Battery Energy Storage Systems (BESS), improving grid stability and efficiency.

- Participation in large-scale government renewable energy tenders, reinforcing South Africa’s clean energy targets.

The Climate Impact: Avoiding 1.9 Million Tons of CO2 Annually 🌍

The projects backed by this investment will have a major emissions reduction impact, preventing an estimated 1.9 million tons of CO2 per year—equivalent to 4% of Norway’s total annual emissions or more than the emissions from Equinor’s Mongstad refinery, Norway’s largest single emissions source.

Strategic Financial Backing for Long-Term Impact 📊

This transaction is part of Norfund’s continued investment in Pele Green Energy, which began in 2023 with an initial NOK 400 million (~USD 38 million) commitment. With the latest funding round:

- Pele will secure a stronger capital base, allowing for scalability and market expansion.

- Nedbank’s involvement strengthens the local financing ecosystem for renewable infrastructure projects.

- The funding underscores the confidence of global and regional investors in South Africa’s clean energy transition.

A Game-Changer for South Africa’s Energy Future ⚡

South Africa remains one of the world’s largest coal-dependent economies, with 90% of its electricity still generated from coal. The country has faced severe power shortages and load shedding, reaching its highest level in over a year just last week. Investments like this are crucial to reducing reliance on coal and accelerating the adoption of renewable alternatives.

Looking Ahead: Strengthening South Africa’s Renewable Energy Ecosystem 🚀

As Pele Green Energy scales its renewable energy solutions, this investment sets a benchmark for private and public sector collaboration in South Africa’s clean energy transition. It also highlights the potential of financial modelling and structured capital solutions in making renewable projects bankable and scalable.

🔍 Are you looking to optimize financial modelling for renewable energy projects? Partner with Finteam to develop tailored financial strategies that drive impact and ensure bankability. Let’s build a sustainable energy future together! ⚡📊