North Africa is rapidly emerging as a key player in the global green hydrogen economy. With abundant solar and wind resources, strategic proximity to Europe, and increasing government support, countries like Morocco, Algeria, Tunisia, and Egypt are positioning themselves as future clean energy exporters.

Why Green Hydrogen?

Green hydrogen, produced via electrolysis powered by renewable energy, offers a zero-carbon alternative to fossil fuels. For North African countries, it represents an opportunity to:

- Diversify energy exports, reducing reliance on oil and gas revenues.

- Attract foreign investment, fostering industrial and economic growth.

- Strengthen energy security, both domestically and for European partners.

- Create jobs, particularly in renewable infrastructure and technology sectors.

Leading Initiatives in North Africa

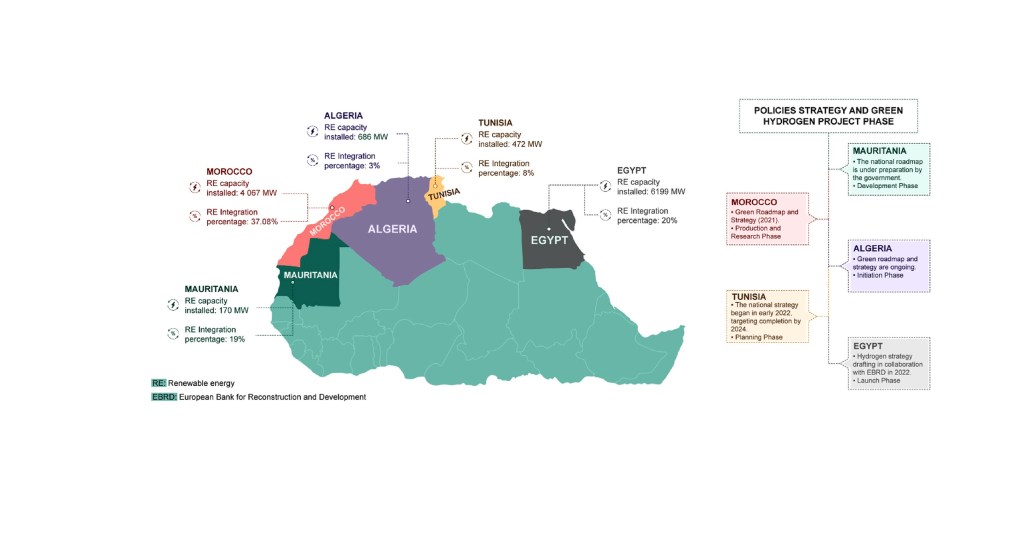

Morocco: A Regional Front-Runner

- €30.3 billion investment in six green hydrogen projects across key provinces.

- Up to 1 million hectares of public land allocated for green hydrogen production.

- Partnerships with international players to produce and export hydrogen and green ammonia.

- Ambition to capture 8% of the global green hydrogen market by 2040.

Egypt: A Green Hydrogen Powerhouse

- $40 billion national hydrogen strategy, with major projects in the Suez Canal Economic Zone.

- Signed seven MoUs with international developers to establish large-scale hydrogen and ammonia production facilities.

- Targeting 5-8% of the global green hydrogen market by 2040, potentially increasing GDP by $10-18 billion.

Tunisia: Growing Momentum

- Six MoUs signed with international energy firms, including TUNUR and AKER Horizons.

- Plans to develop large-scale green hydrogen infrastructure for domestic use and export.

Algeria: Untapped Potential Amidst Hydrocarbon Focus

- Vast renewable energy capacity, particularly in solar, remains largely untapped.

- The government has launched a National Hydrogen Roadmap, aiming to supply 10% of Europe’s hydrogen needs by 2040.

- Despite these ambitions, Algeria continues to focus heavily on hydrocarbon exploration and production, with Sonatrach investing in both fossil fuels and emerging hydrogen projects.

Strategic Importance for Europe

North Africa’s geographic proximity makes it a natural supplier for Europe’s growing demand for green hydrogen. The European Union’s Green Deal aims to import 10 million tons of renewable hydrogen by 2030, creating a significant export opportunity for North African producers.

Financial Modelling & Investment Considerations 📊

For investors and financial modellers, North Africa’s green hydrogen sector presents both opportunities and challenges:

- CapEx & OpEx Analysis: Assessing the initial investment in electrolysis plants, renewable power infrastructure, and hydrogen transport systems.

- Revenue Projections: Modeling long-term hydrogen pricing trends, factoring in EU demand, carbon pricing, and government incentives.

- Debt & Equity Structuring: Evaluating blended finance models, concessional loans, and private-sector funding options.

- Risk Assessment: Managing risks related to policy shifts, infrastructure development timelines, and hydrogen transportation logistics.

Looking Ahead 🚀

With billions in planned investments, North Africa is on track to become a global hub for green hydrogen. As governments and private investors ramp up efforts, financial modelling and strategic planning will be key to ensuring the bankability and scalability of these projects.

🔍 Interested in financial modelling for renewable energy projects? Partner with Finteam to develop tailored financial strategies that maximize bankability and impact. 🌍📊