Earlier this month, German asset manager KGAL merged its portfolio company SunErgy with EWIA Green Investments, creating a powerful pan-African player in the renewable energy sector. The move consolidates mini-grid and solar-as-a-service models to tackle Africa’s electrification gap while offering new opportunities for impact-oriented investors.

Merger Highlights 🔄

- EWIA acquires 100% of SunErgy; in return, SunErgy’s shareholders receive stakes in EWIA.

- SunErgy’s mini-grid expertise complements EWIA’s C&I solar-as-a-service platform.

- Focus countries: Ghana, Nigeria (EWIA) and Cameroon (SunErgy).

- Post-merger workforce: 76 employees.

Why This Merger Matters 🌍

- 600 million Africans lack electricity access.

- Frequent blackouts and high diesel costs (up to €0.80/kWh) undermine economic stability.

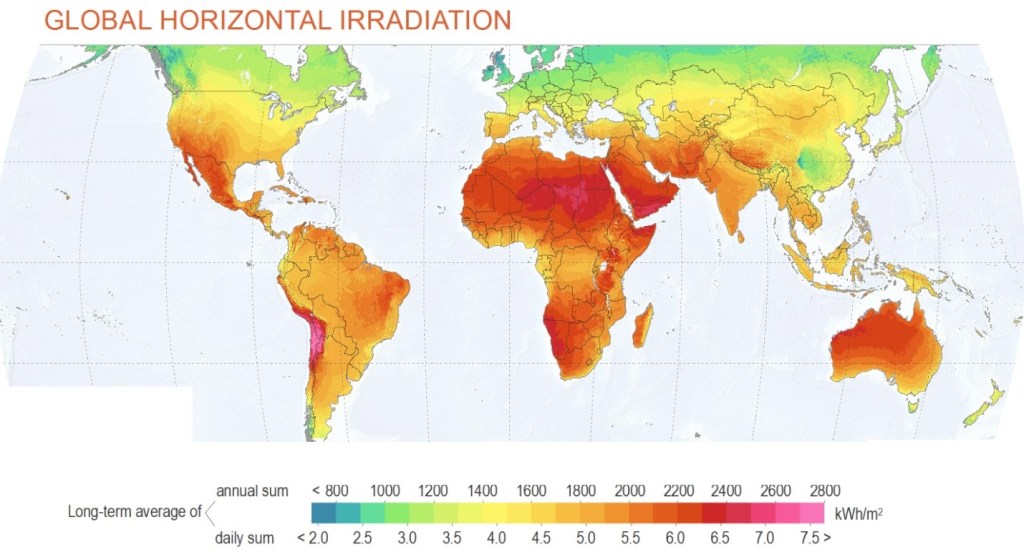

- Sub-Saharan Africa receives 1,800–3,000 hours of sunshine annually, making it ideal for solar generation.

By combining business models, the new entity will offer:

- Mini-grids for rural electrification (e.g. SunErgy’s 92-village project in Cameroon).

- C&I solar-as-a-service solutions tailored for SMEs.

- End-to-end services: Planning, financing, construction, and operations.

Investment Strategy and Financial Modelling Insights 📊

This strategic merger opens a broader canvas for financial modellers and investors, particularly in:

- Project bundling across regions and models (mini-grids + rooftop C&I).

- Revenue diversification through blended customer segments.

- IRR-enhancement via diesel replacement savings.

- Risk-adjusted cash flow modelling for donor-backed and private offtakers.

💡 Investors can model returns using tools like the Finteam Solar PV Model Template, tailored for distributed and utility-scale solar.

Strategic Vision Ahead 🚀

With strong backing from KGAL, EWIA is now positioned as a leading clean energy provider in Africa, bridging infrastructure gaps while enabling growth in underserved markets. The synergy between urban commercial clients and rural communities under one roof represents a powerful new chapter for energy access on the continent.

🔍 Interested in modelling diversified solar portfolios or investing in Africa’s energy transition? Reach out to Finteam for strategic financial guidance.