Overview: A Windfall Opportunity 📈

Morocco’s extensive Atlantic coastline, stretching over 3,500 km, offers a remarkable opportunity for offshore wind energy development. With an estimated potential of up to 250 GW, this resource surpasses the country’s onshore wind capacity by a factor of ten. Strategically located near Europe, Morocco stands poised to become a significant player in the global renewable energy market. 🌿

Strategic Locations and Wind Resources 🌪️

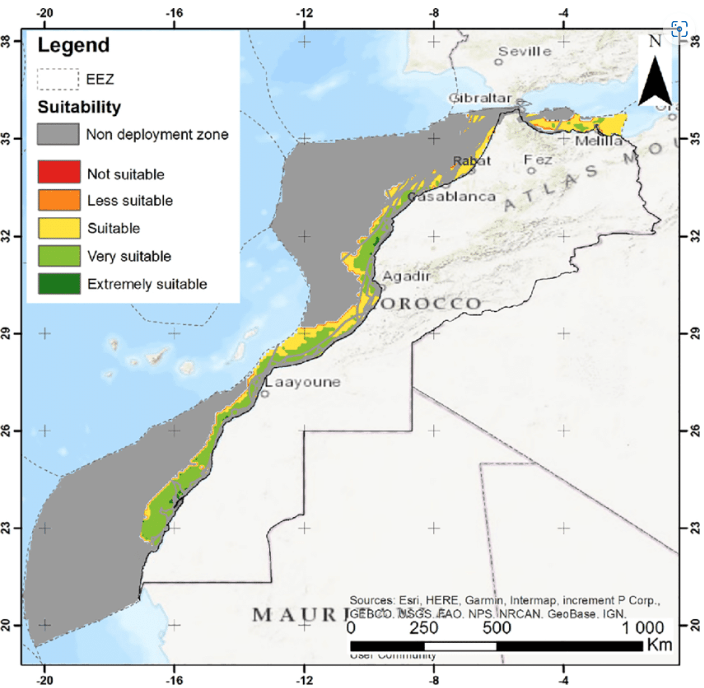

Key areas identified for offshore wind development include:

- Strait of Gibraltar: Known for consistent high wind speeds. 📉

- Essaouira–Agadir Corridor: Characterized by shallow waters and favorable conditions for fixed-bottom turbines. 🌊

- Southern Atlantic Coast: Regions like Tarfaya and Dakhla exhibit average wind speeds exceeding 9 m/s at 40 meters elevation. 🌬️

These sites offer optimal conditions for offshore wind farms, combining strong wind resources with suitable maritime environments. 🌿

Financial Modeling Considerations 📋📊

From a financial modeling standpoint, several factors are critical:

- Capital Expenditure (CAPEX): Initial investments are substantial, with estimates around $6 billion to develop offshore wind plants covering over 20% of Morocco’s current power capacity. 💸

- Operational Expenditure (OPEX): Ongoing maintenance and operational costs must be accurately projected to ensure financial viability. 🚧

- Revenue Streams: Potential income from power purchase agreements (PPAs), export opportunities, and government incentives should be incorporated into financial models. 💰

- Risk Assessment: Models must account for variables such as currency fluctuations, policy changes, and environmental factors. ⚡

Utilizing comprehensive financial models enables stakeholders to evaluate the feasibility and profitability of offshore wind projects effectively. 📆

Policy and Institutional Support 💼🚀

The Moroccan Agency for Sustainable Energy (Masen), in collaboration with the European Investment Bank (EIB), is spearheading efforts to assess offshore wind potential. A €2 million grant has been allocated for feasibility studies, focusing on regions like Essaouira. These initiatives aim to lay the groundwork for pilot projects and attract further investment. 🙌

International Collaboration and Export Potential 🛋️🌎

Morocco’s offshore wind capacity not only serves domestic needs but also presents opportunities for international energy export. Projects like the proposed 2,500-mile subsea cable to the UK exemplify the country’s potential to supply renewable energy to Europe. Such ventures require meticulous financial planning to address the complexities of cross-border energy transmission. 🔌

Conclusion: Charting the Course Ahead ✈️📅

Morocco’s offshore wind resources offer a transformative avenue for sustainable energy development. By leveraging strategic locations, robust financial modeling, and supportive policies, the country can harness this potential to meet both national and international energy demands. 🌿🌬️

For stakeholders interested in exploring these opportunities, Finteam provides specialized financial modeling services tailored to renewable energy projects. Our expertise ensures comprehensive analysis and strategic planning to navigate the complexities of offshore wind investments. 🧱

📩 Contact Finteam to discuss how we can support your renewable energy initiatives.