On 9 June 2025, the 140MW Ishwati Emoyeni Wind Farm in Western Cape province in South Africa achieved financial close, marking a historic first for the country’s renewable energy sector. This ZAR 4.9 billion (EUR 242.5 million) project becomes South Africa’s first large-scale renewable energy initiative to reach financial close with an energy trader – NOA Group – as the offtaker. 💸🌬️📈

Innovative Energy Trading Structure 🌍🔌🌞

NOA Group, a licensed energy trader backed by African Infrastructure Investment Managers (AIIM), will aggregate power from the Ishwati Wind Farm and other sources. This energy will be wheeled through the Eskom grid to industrial and commercial end-users across the country. The significance lies in NOA’s ability to blend generation from multiple renewable projects (wind, solar, battery) and offer a firm supply profile – a vital shift in a market moving away from traditional utility models. 🔁🏭🔋

NOA received its trading licence from NERSA in January 2025, enabling it to sign a long-term Power Purchase Agreement (PPA) with the Ishwati project. This model introduces a flexible, market-driven mechanism in a traditionally centralized power sector. 📑⚖️📉

Project Consortium and Structure 🏗️🤝🌐

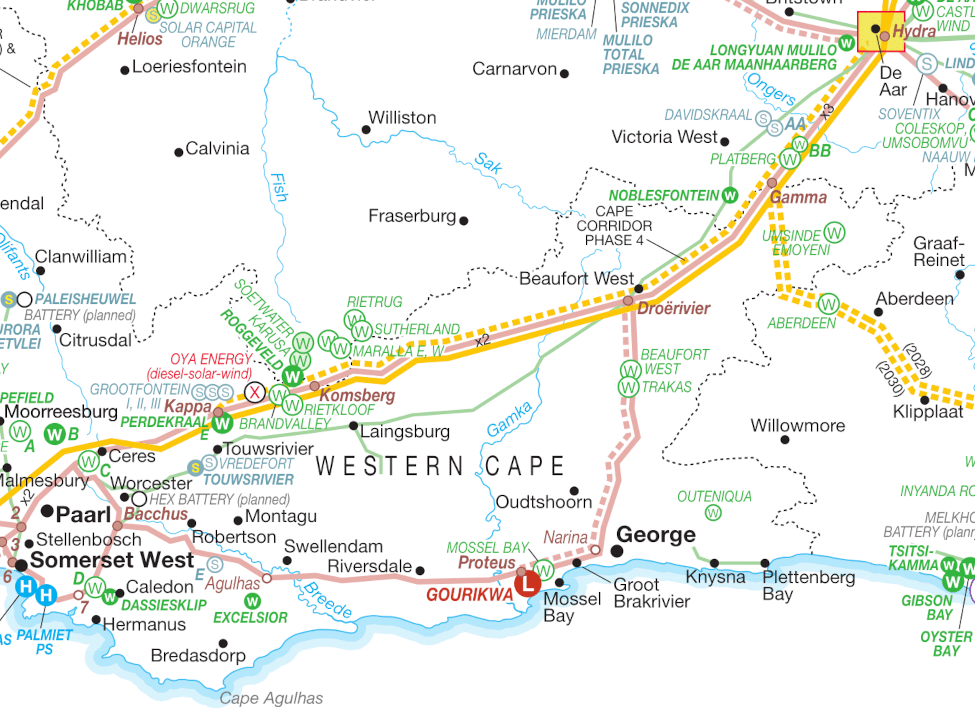

The Ishwati Wind Farm was developed by African Clean Energy Developments (ACED) and co-sponsored by the IDEAS Fund (managed by AIIM) and Reatile Group. Standard Bank South Africa served as the mandated lead arranger. The project comprises 32 Vestas 4.5MW turbines and is situated adjacent to the Umsinde and Khangela Emoyeni Wind Farms, forming a growing cluster of renewable assets. 🌾🌪️💼

Legal and advisory roles were executed by Werksmans Attorneys, A&O Shearman, DLA Piper, Capic, Bastion, and Lockton. Construction will be managed by ACED, while operations and asset management will be handled by EIMS Africa. 🧾🔧🛠️

Financial Modelling and Trader Dynamics 📊🧠💼

From a financial modeller’s standpoint, this transaction sets a new precedent.

Dynamic Excel-based tools can help developers assess various scenarios, including load factor variations, capex inflation, and FX impacts (ZAR to EUR/USD). For similar analysis, the Finteam Solar PV Model Template is available here: Finteam Solar PV Model Template 💻📈🧮

Strategic Implications for South Africa 🌍📢💬

The Ishwati Emoyeni project exemplifies the shift toward liberalised power markets in South Africa. It highlights the growing role of traders and flexible PPAs in driving renewable investments outside of the government-led Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). ⚡📉🔄

The ability of NOA to contract, aggregate, and deliver clean energy profiles adds market efficiency and accelerates private sector participation. For industrial customers seeking decarbonisation and power reliability, this model offers tailored, long-term solutions. 🏢🌱🔋

Conclusion 🎯📍📝

The financial close of the Ishwati Emoyeni Wind Farm represents a milestone not only for the consortium behind it but for South Africa’s renewable energy sector at large. As financial structures evolve and traders take a more prominent role, financial modellers and investors must adapt to multi-source, multi-buyer realities. 🌐🔍📊