Octopus Energy Generation has launched the Octopus Energy Power Africa Fund (OEPA), targeting USD 250 million in investment over three years, to accelerate the continent’s clean energy transition. The fund launches with an initial USD 60 million and marks Octopus’ first dedicated push into the African renewables landscape.

🚀 Fund Objectives & Deployment Strategy

The OEPA Fund aims to:

- Deploy capital into rooftop solar, battery energy storage systems (BESS), EV charging infrastructure, and grid upgrades

- Focus on Sub-Saharan Africa, addressing underserved communities and catalysing energy access

- Operate through a joint initiative with Pembani Remgro Infrastructure Managers (PRIM) to enhance local investment models

Launching during the Africa Energy Forum in Cape Town, the initiative reflects Octopus Energy’s commitment to global climate solutions—connecting European capital with African clean energy potential.

🌞 Why Africa, Why Now?

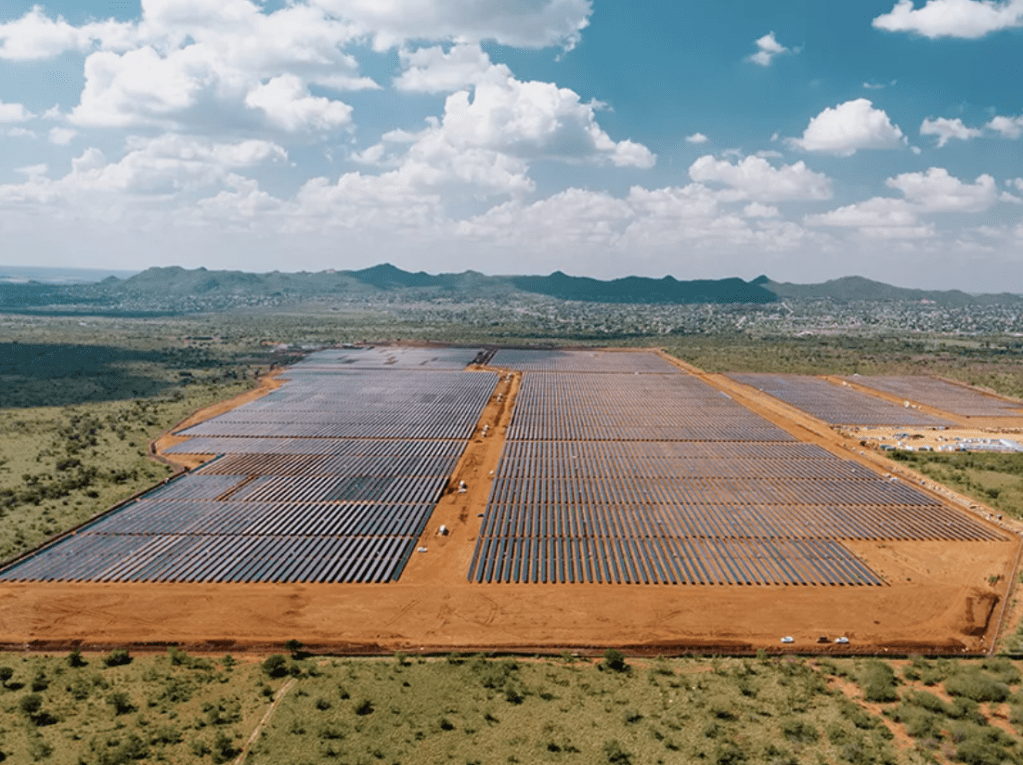

Africa is home to nearly 40% of the world’s renewable potential, yet it captures just 2% of global clean energy investment. The continent’s high solar irradiation and emerging energy demand curves make it an ideal testing ground for decentralized energy solutions.

OEPA intends to bridge this gap by enabling:

- Scalable solar deployment in off-grid or weak-grid areas

- Commercial and industrial (C&I) solar-battery systems near urban centers

- EV charging networks to support electric transport adoption

🏗 Track Record & Pipeline

Octopus has already made strides in Africa through:

- Investing in MOPO, a solar battery firm serving off-grid households

- Partnering with Akuna Group to build Sierra Leone’s first wind farm on Sherbro Island

With OEPA, Octopus aims to build a diverse pipeline of high-impact projects while de-risking private capital entry into the African power sector.

📊 Financial Modelling & Investor Strategy

From a financial modeller’s lens, OEPA’s structure provides:

- Early-stage concessional equity de-risking for commercial investors

- Multi-country exposure with technology mix hedging (solar, storage, EV infra)

- Opportunities to model distributed revenue streams, including PPA income, carbon credits, and grid service payments

Scenario analysis will be critical in capturing:

- Varying regulatory timelines across jurisdictions

- FX risk and repatriation strategies

- Climate-related stress-testing for assets exposed to temperature volatility or drought

🤝 Strategic Alignment & Impact

The fund is backed by credible global partners: Origin Energy, Tokyo Gas, Generation IM, and CIPPB. It aligns with SDGs on clean energy (Goal 7), industry innovation (Goal 9), and climate action (Goal 13).

By leveraging local partners and infrastructure specialists like PRIM, Octopus aims to combine financial innovation with regional know-how, setting a new benchmark for blended finance in emerging markets.

🔎 Summary for Developers & Modellers

- Africa is not just an opportunity—it’s a climate necessity

- OEPA offers replicable structures for aggregating small-scale assets

- For modelers: focus on portfolio aggregation, BESS dispatch modelling, and multi-asset IRR alignment

- Institutional investors: tap into a high-growth, low-penetration market with catalytic capital

🌍 Final Thoughts

OEPA is more than a fund—it’s a catalyst for reshaping how clean energy is financed, deployed, and scaled in Africa. By marrying smart capital with local expertise, Octopus Energy is positioning itself as a transformative force in the continent’s transition. For investors and developers alike, this is not just a financial opportunity, but a chance to participate in one of the most vital sustainability stories of our generation.

Let’s collaborate to power the next chapter of Africa’s clean energy future. 🌞⚡