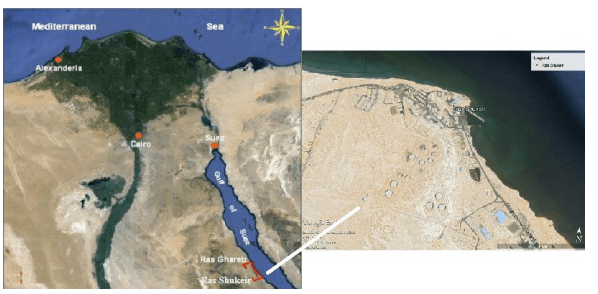

Egypt’s renewable energy trajectory is receiving a significant boost as Scatec ASA has signed a 25-year USD-denominated PPA with the Egyptian Electricity Transmission Company (EETC) to develop a 900 MW onshore wind farm at Ras Shukeir, along the Gulf of Suez . This new project joins Scatec’s expanding portfolio in Egypt, building on the momentum of their 1.1 GW solar + storage Obelisk project. 📈🌱🔋

By developing this project in Ras Shukeir—a region known for consistent high wind speeds—Scatec is strategically positioned to deliver cost-efficient, dispatchable renewable energy. This will help stabilize Egypt’s grid while decreasing reliance on fossil fuel imports. 🌬️⚡🔌

📌 Why Ras Shukeir? Premium Wind Resources

Ras Shukeir is situated in one of Egypt’s highest wind potential corridors along the Gulf of Suez. The region boasts wind speeds averaging 8–10 m/s, making it ideal for high-yield wind farms. The location has already attracted attention from other IPPs, confirming its viability and attractiveness for large-scale renewable projects. 🌬️📍📈

🔧 Project Timeline & Next Steps 🛠️📆🚀

The PPA signing secures offtake. Final DFI or commercial debt details are pending, consistent with Scatec’s mix-and-match financing approach seen in prior deals . 📝💰📉

Once wind measurement campaigns conclude in mid‑2026, the project is expected to progress quickly toward financial close and construction, with a potential COD by late 2027 or early 2028. This timeframe aligns with Egypt’s broader energy targets under Vision 2030. 📊🏗️🇪🇬

💹 Financial & Modelling Insights 🧮📊🔍

From a financial modeller’s perspective, this project offers a rich canvas to explore complex hybrid debt structures, yield profile modelling, and DSCR simulations. The long-term USD PPA insulates the project from local currency volatility, a key concern in emerging markets. Careful modelling of wind capacity factors, O&M schedules, and loan amortization will be vital to validate IRR and NPV expectations. 🧾💡🔧

🌱 Strategic & ESG Considerations 🌿⚖️📉

ESG alignment will be critical. The project can play a substantial role in Egypt’s decarbonization strategy by replacing thermal generation. However, environmental diligence must also account for biodiversity, particularly migratory bird routes across the Gulf of Suez. Leveraging best practices in environmental mitigation will further solidify Scatec’s commitment to responsible renewable development. 🕊️📘🌎

🧭 From a Financial Modeller’s Standpoint 🔢💼💡

This project demands high-quality wind data analysis, layered scenario modelling, and sensitivity checks. Equity partners and DFIs will expect transparent, stress-tested outputs that demonstrate both bankability and resilience. As with Obelisk, the use of bridge financing followed by long-term project finance might be replicated. Modellers should anticipate interest rate and FX hedging strategies as well. 🧠📊🧾

🏁 Summary 📚🔚🌬️

Scatec’s Ras Shukeir wind project represents a strategic milestone for Egypt’s renewable ambitions:

This project is a prime case study for modellers designing large-scale wind IPPs in frontier markets—melding revenue certainty, resource risk modelling, and structured finance sophistication. 📐📈📘