Anzana Electric Group is an independent power producer (IPP) and electricity distribution company focusing on Africa. The firm develops, finances, and operates grid-connected and off-grid energy projects, with a particular emphasis on renewable technologies such as hydropower and solar. With operational footprints in the Great Lakes and East Africa regions, Anzana combines technical expertise with a deep understanding of local regulatory frameworks to advance energy access and regional development. 🌱🌐🔧

Anzana Electric Group has signed a preliminary partnership agreement with Ruzizi III Holding Power Company Limited (RHPCL) to advance the $760 million Ruzizi III Regional Hydropower Project. This 206 MW initiative is the first tri-national public-private partnership in the Great Lakes Region, involving Burundi 🇧🇮, the Democratic Republic of Congo (DRC) 🇨🇩, and Rwanda 🇷🇼. 📘🤝🌊

Project Overview 📊

- Capacity: 206 MW

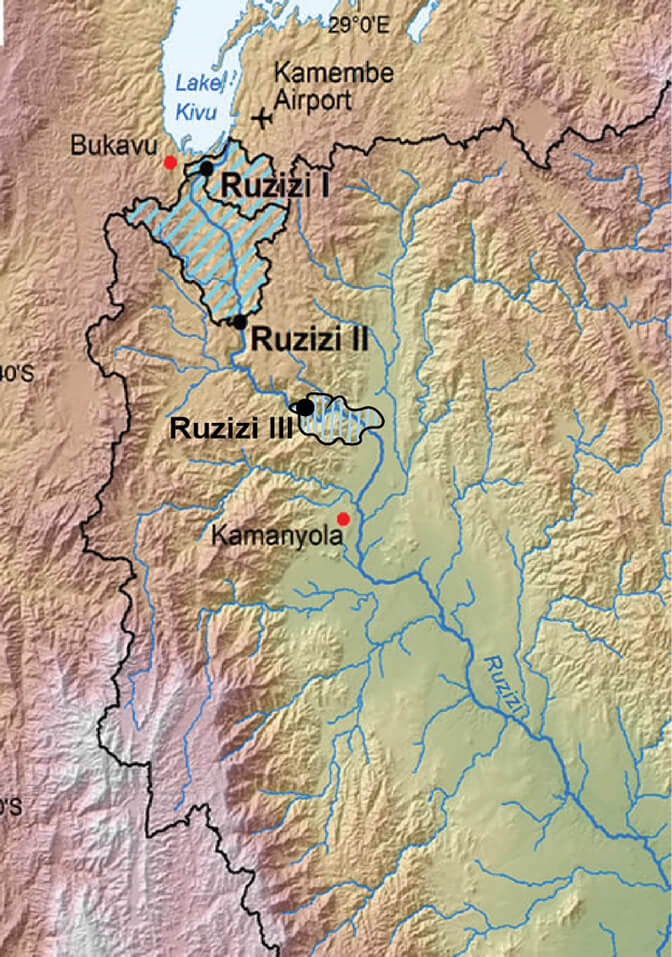

- Location: Ruzizi River, between western Rwanda and eastern DRC 🇨🇩

- Beneficiaries: Approximately 30 million people across Burundi 🇧🇮, DRC 🇨🇩, and Rwanda 🇷🇼

- Impact:

- Nearly doubles Burundi’s current capacity

- Boosts Rwanda’s capacity by 30%

- Provides critical baseload and dispatchable power to eastern DRC

- Expected Commissioning: As early as 2030

Strategic Partnership & Investment Trajectory 💼 🤝🧭💡

Anzana Electric Group has expressed interest in acquiring a minority equity interest in RHPCL. Both parties aim to finalize a binding partnership agreement by September 15, 2025, wherein Anzana may acquire no less than a 10% equity stake. 📄📆🔍

Financial Modelling & Development Implications 📈 🧮🏗️💬

The Ruzizi III project is structured under a Build-Own-Operate-Transfer (BOOT) model, with RHPCL as the private sector partner. The financing structure must carefully account for multi-jurisdictional risks, water resource variability, and off-taker bankability across three sovereigns. 📘📉💼

Key financial modelling metrics under consideration:

- IRR targets of 11-13%, driven by long-term Power Purchase Agreements (PPAs).

- NPV sensitivity to dispatchability and grid integration in eastern DRC.

- Use of blended finance combining concessional loans from DFIs with commercial tranches.

International financiers supporting the project include the World Bank, African Development Bank, and European Investment Bank. Anzana’s participation may improve project bankability and mitigate political risk, potentially unlocking further syndicated loans or guarantees. 🌍📊🔒

Regional Significance 🌍 🏞️🏛️🌐

The Ruzizi III project is not merely an energy infrastructure investment—it is a regional integration tool. By delivering stable and scalable electricity access, it enhances: 💡📈🌱

- Economic competitiveness across the Great Lakes Region.

- Social development through electrification of rural and peri-urban communities.

- Political stability via cross-border cooperation and interdependence.

It aligns with SDG 7 (Affordable and Clean Energy) and contributes to regional climate resilience strategies by replacing thermal generation with hydropower. 🔋🌡️🔁

Conclusion & Outlook 🌅📘📣

Anzana’s move toward equity participation in RHPCL marks a pivotal moment in scaling African energy infrastructure through private sector partnerships. With a firm commitment to sustainable development and regional growth, the Ruzizi III project sets a compelling benchmark for future PPPs in emerging markets. ⚙️🔋🛤️

📊 For financial modellers, this project offers a case study in multi-country PPA alignment, water flow forecasting, and cross-border risk allocation.

🌱 For sustainability advocates, it embodies progress toward a just energy transition in Africa.