The European Union’s Carbon Border Adjustment Mechanism (CBAM) is poised to reshape global trade dynamics, with significant implications for African economies. As CBAM transitions from its reporting phase (2023–2025) to full implementation in 2026, African exporters, particularly in carbon-intensive sectors, must navigate new challenges to maintain competitiveness in the EU market. ⚖️🌐📉

CBAM’s Implications for African Economies 🌍🏭💶

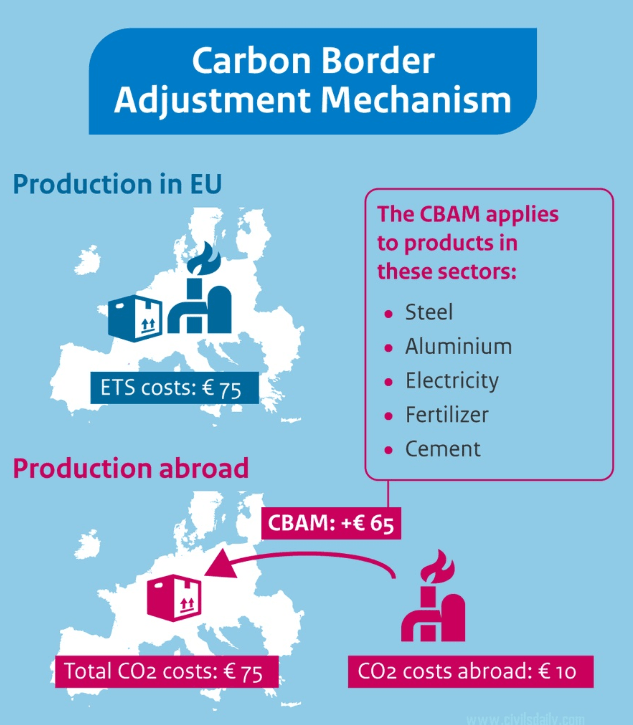

CBAM aims to prevent carbon leakage by imposing a levy on imports based on their embedded carbon emissions, aligning the cost of imported goods with the EU’s internal carbon pricing. Initially targeting sectors like iron and steel, cement, aluminium, fertilisers, hydrogen, and electricity, the mechanism will require importers to purchase CBAM certificates corresponding to the carbon content of their products. 🧾📦⚡

For African countries, the economic ramifications are substantial. Studies indicate that if CBAM were applied to all imports, African exports to the EU could decline by 5.72%, with a potential GDP reduction of 1.12%, equating to approximately €31 billion based on 2021 figures. Countries heavily reliant on carbon-intensive exports, such as Mozambique, Zimbabwe, South Africa, Egypt, and Morocco, are particularly vulnerable. 📉🌍🛠️

To provide a specific case, South Africa’s ferrochrome and aluminium exports could face CBAM fees estimated at €200 million annually if emissions are not reduced or offset. 📊🛢️⚒️

Incorporating CBAM into Financial Models 💼📊🔍

To assess and mitigate the financial impact of CBAM, African exporters and financial analysts should integrate CBAM-related considerations into their financial models. Key components include: 🧮🌐📈

1. Emissions Quantification

- Data Collection: Accurate measurement of embedded emissions in exported products is crucial. This involves gathering data on production processes, energy sources, and supply chains.

- Standardized Methodologies: Employ internationally recognized standards, such as the Greenhouse Gas Protocol, to ensure consistency and credibility in emissions reporting.

2. CBAM Cost Estimation

- Certificate Pricing: Estimate the cost of CBAM certificates by analyzing the EU Emissions Trading System (ETS) carbon prices, which fluctuate based on market dynamics. As of mid-2025, EU carbon prices hover around €80 per tonne CO₂, though volatility is common. 📈💶📉

- Adjustment Calculations: Determine the financial impact by calculating the difference between the EU carbon price and any existing carbon pricing mechanisms in the exporting country.

3. Scenario Analysis

- Market Sensitivity: Model various scenarios considering changes in carbon prices, exchange rates, and production costs to understand potential financial outcomes.

- Policy Developments: Incorporate potential policy changes, such as expansions of CBAM to additional sectors or modifications in exemption criteria.

4. Strategic Planning

- Investment Decisions: Evaluate the cost-benefit of investing in low-carbon technologies or processes to reduce CBAM liabilities.

- Supply Chain Optimization: Assess opportunities to source materials or energy from lower-emission alternatives to minimize embedded carbon content.

Financial modellers should also simulate the impact of CBAM on project IRRs (Internal Rate of Return) and NPVs (Net Present Value), as higher export costs may erode margins. For example, a 10% increase in export-related costs could reduce project IRR by 2-3 percentage points in high-emission sectors. 🔢📉📘

Policy Recommendations and Support Mechanisms 🏛️📘🤝

To alleviate the adverse effects of CBAM on African economies, several strategies can be pursued: 💬🌍🔧

- Negotiating Exemptions: Engage with EU policymakers to advocate for exemptions or phased implementations for least-developed countries (LDCs).

- Capacity Building: Invest in infrastructure and training to enhance emissions monitoring, reporting, and verification capabilities.

- Financial Assistance: Seek international funding and technical assistance to support the transition to low-carbon production methods.

- Regional Collaboration: Leverage platforms like the African Continental Free Trade Area (AfCFTA) to coordinate responses and share best practices.

One additional recommendation is the creation of regional carbon registries in Africa to standardize data collection and facilitate more transparent CBAM reporting and potential offset mechanisms. 🧰📄📡

Conclusion 🧠📈🌱

The implementation of CBAM presents both challenges and opportunities for African exporters. By proactively integrating CBAM considerations into financial models and engaging in strategic planning, businesses can mitigate risks and position themselves for sustainable growth in a carbon-conscious global market. 🌍💼🔋