Carbon Capture and Storage (CCS) is increasingly recognized as a pivotal technology in the global effort to achieve net-zero emissions. For financial modelers, CCS presents a complex landscape of high capital expenditures, uncertain revenue streams, and evolving regulatory frameworks. This article delves into the financial modeling aspects of CCS projects, highlighting key considerations and methodologies. 💼📉🧮

Understanding the CCS Value Chain 🔍🏗️🌐

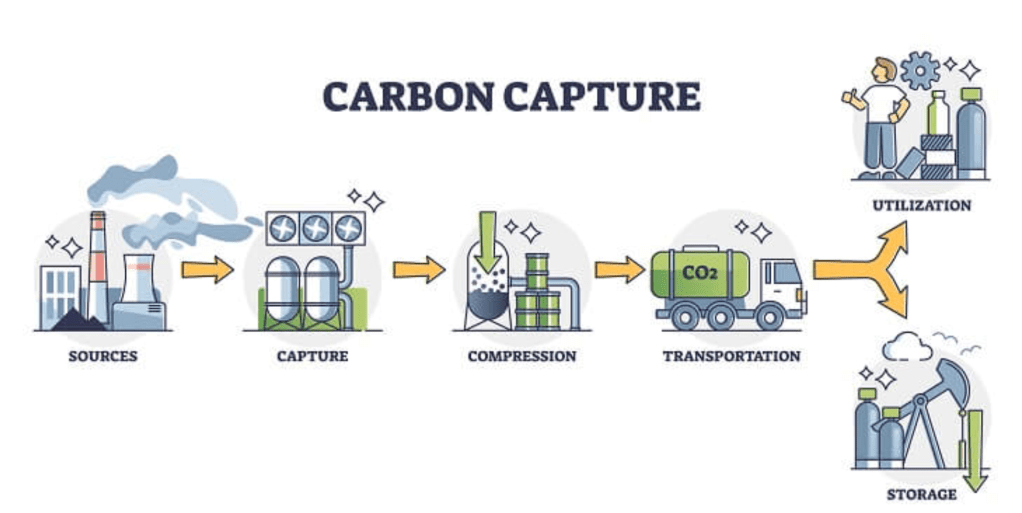

CCS involves capturing carbon dioxide emissions from industrial processes, transporting the CO₂ to storage sites, and securely storing it underground. Each stage—capture, transport, and storage—has distinct financial implications. 💨🚛📦

From a modeling perspective, it’s essential to treat each component as a modular cash flow stream. For instance, capture costs may vary based on source concentration and technology used (e.g., post-combustion vs. oxy-fuel combustion), while transport infrastructure could involve shared or dedicated pipelines, with implications for CAPEX and OPEX allocation. Storage often involves saline aquifers or depleted oil fields, both requiring geological risk modeling and regulatory compliance costs. 🛠️💼🔬

Key Financial Metrics 📈💡💷

When evaluating CCS projects, several financial metrics are paramount. 💵📊🔎

For example, IRR thresholds for viability often exceed 10% due to the project’s risk profile and long payback periods. NPV assessments must incorporate escalated O&M costs over a 20–30 year lifespan, factoring in inflation, carbon price evolution, and degradation of capture efficiency. Project finance models must also account for leverage constraints—most CCS ventures, especially first-of-a-kind (FOAK) projects, attract debt ratios below 60% due to perceived risks. 🧾💹🔍

For instance, a study on CCS in the UK North Sea demonstrated a post-tax NPV of £261 million and an IRR of 12%, with a payback period of nine years. 🇬🇧🛢️📆

Incorporating Uncertainty: Monte Carlo Simulations 🎲📉📈

Given the uncertainties in CCS projects—such as fluctuating carbon prices and technological risks—Monte Carlo simulations are invaluable. By running thousands of scenarios, financial modelers can assess the probability distribution of outcomes, providing a more comprehensive risk assessment. 🤖📊🧠

These models typically stress-test assumptions around input CAPEX (±15–30%), carbon price volatility, injection rates, and storage validation delays. In one illustrative case, Monte Carlo simulations indicated that only 45% of scenarios yielded a project IRR above the WACC threshold of 8%, highlighting the need for stronger policy incentives or blended finance. 📌📈🔐

Revenue Streams and Incentives 💰🏛️🔋

CCS projects often rely on a mix of revenue sources and incentives. 📉📈📜

Potential revenues include carbon credit trading (EU ETS, voluntary markets), off-take agreements with high-emitting industries, and, in some jurisdictions, enhanced oil recovery (EOR) revenues. In the U.S., Section 45Q of the Internal Revenue Code provides a tax credit of up to $85 per ton of CO₂ permanently stored. Accurately modeling these inflows requires scenario trees or decision-tree analysis to forecast upside/downside cases. 🧾💡📄

For example, the Petra Nova project in Texas leveraged CO₂ for EOR, enhancing oil recovery while sequestering emissions. 🛢️🌎⚙️

Regulatory and Policy Considerations 📚🏢⚖️

Government policies play a crucial role in CCS viability. In the UK, Ofgem has developed a Price Control Financial Model to guide CO₂ transport and storage projects, ensuring transparency and financial stability. 🧾🔍🗂️

Understanding regulatory regimes is essential when estimating risk-adjusted discount rates. Jurisdictions with well-defined liability periods, carbon price floors, or storage indemnity schemes (e.g., Netherlands, Norway) offer lower risk premiums, thus improving financial attractiveness. These nuances must be embedded in the weighted average cost of capital (WACC) calculations and sensitivity layers. 🇳🇱📉🛠️

Advanced Financial Modeling Tools 🧮🛠️📘

Modern financial modeling for CCS projects incorporates various tools and methodologies. 🧑💻📈🧭

Tools include dynamic cash flow models with DCF logic, project finance debt sculpting algorithms, and multi-sheet Excel models integrated with VBA macros for sensitivity toggling. In more advanced applications, probabilistic modeling is supported using software like @RISK or Python-based packages like NumPy and SciPy. Some models also adopt real-options valuation to assess future retrofitting or expansion potential. 🔧📊📂

Conclusion 🌱📊🧩

For financial modelers, CCS projects present both challenges and opportunities. By employing advanced modeling techniques and staying abreast of policy developments, professionals can navigate the complexities of CCS investments, contributing to a sustainable and low-carbon future. 🌍⚡📈

For those interested in a detailed financial modeling template tailored to CCS, check out this tool on Eloquens: Carbon Capture Plant Sequestration Model. 🧾📥📊