As water scarcity intensifies across the globe, large-scale desalination projects are emerging as strategic investments in national water resilience plans. For financial modellers, these projects pose unique challenges—high upfront capex, energy-intensive processes, long lifespans, and regulatory complexity. This article outlines a structured approach to desalination financial modelling, highlighting key assumptions, metrics, and stress factors, with reference to the Casablanca SWRO plant in Morocco where useful. 💦📈🛠️

1. Key Assumptions & Project Structure 💼🧮🌊

Start with defining:

- Capacity: Typically measured in m³/day (e.g., 300,000–800,000 m³/day).

- Technology: Reverse osmosis (RO) dominates due to cost and energy efficiency.

- Phased Rollouts: Break models into construction and commissioning phases.

- Useful Life: 25–30 years with major maintenance every 10–15 years.

- Offtake Types: Municipal, industrial, and agricultural consumption mix.

Example: The Casablanca desalination plant in Morocco is designed in two phases, reaching 822,000 m³/day and supplying water to over 7.5 million people, with 50 million m³ allocated to agriculture. 🚰🔧📊

2. Capex & Financing Design 💰📉🏗️

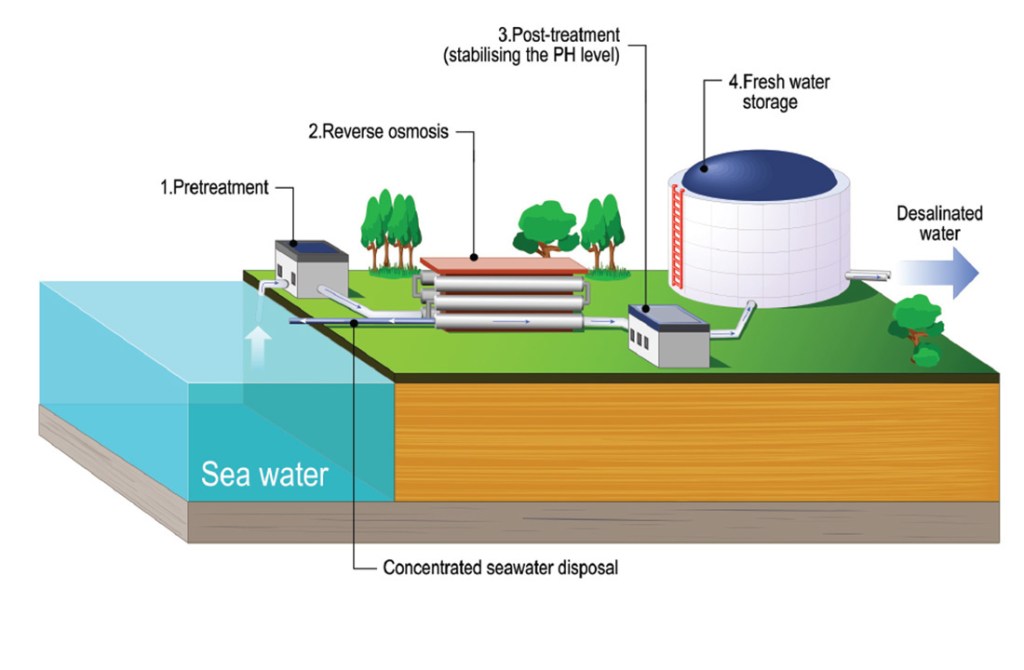

Desalination capex includes pretreatment units, RO membranes, brine management, and pipelines. The financial model should include:

- Construction Schedule: Reflect phased build-out (e.g., Phase 1 by 2026, Phase 2 TBD).

- Transport Infrastructure: Storage, pumping stations, 100+ km pipelines.

- Financing Sources: Blend equity, senior debt, concessional loans, and grants.

- Benchmarks: Capex ~US$1,000–$1,500 per m³/day capacity.

Casablanca’s US$14.3 billion program includes US$301 million for water transport infrastructure and is delivered under a PPP model led by ACCIONA. 💼🏦💡

3. Revenue Modeling & Tariffs 📊💸📈

Revenue is derived from Water Purchase Agreements (WPAs) or usage-based tariffs:

- Municipal Tariffs: Often fixed with annual indexation.

- Agricultural Supply: Discounted or subsidized.

- Take-or-pay Clauses: Critical for debt structuring.

In Morocco, the tariff is set at 4.48 DH/m³ (~US$0.45). Model should forecast volumetric uptake, apply ramp-up curves post-commissioning, and consider escalation clauses. 💧📝📆

4. Operating Costs & Energy Use ⚙️🔋📉

Energy can account for 40–60% of opex. Consider:

- Power Source: On-site renewables vs grid power.

- Other Opex: Membrane replacement cycles, labor, chemicals.

- Automation: Fully automated systems reduce recurring costs.

The Casablanca facility will be 100% powered by renewables and is fully automated, lowering operating risk. 🌿💻🔌

5. Risk & Sensitivity Analysis 📉🧪🔍

Key sensitivities:

- Electricity Prices: Model LCOE for renewables vs grid.

- Capex Overruns: Apply 10–20% contingency.

- Currency Risk: FX mismatch between debt (USD/EUR) and revenues (local).

- Demand Volatility: Use drought and water scarcity scenarios.

Run Monte Carlo or tornado analyses on tariffs, costs, and construction timelines. 💥📊🧮

6. ESG & Regulatory Considerations 🌱📘⚖️

Desalination comes with environmental and regulatory constraints:

- Brine Discharge: Include costs of treatment and compliance.

- Carbon Footprint: Especially relevant for grid-powered plants.

- Regulatory Support: Long-term policy stability improves project bankability.

Morocco’s national water strategy aims to scale desal capacity from 9 to 20 plants by 2030, ensuring policy alignment for projects like Casablanca. 🌍💬📑

7. Outputs & Decision Tools 📊🖥️📉

A robust model delivers:

- Equity & Project IRRs

- NPV and LCOW (Levelized Cost of Water)

- DSCR profiles under base and stress cases

- Sensitivity dashboards for tariffs, opex, capex, and FX

For practical implementation, you can explore the Desalination Water Treatment Plant 10-Year Financial Model available on Eloquens: https://www.eloquens.com/tool/0aXLiwRa/finance/industry-specific-financial-models/desalination-water-treatment-plant-10-year-financial-model?ref=finteam 🧰📘💡

Conclusion 📌📈💧

Financial modelling for desalination projects is a technically layered exercise that integrates infrastructure engineering, tariff policy, ESG planning, and long-term risk analysis. The Casablanca SWRO plant, Africa’s largest, exemplifies the scale and sophistication required to build investment-grade water infrastructure. For modellers, ensuring the model captures dual-phase rollouts, renewable integration, and ESG compliance is critical to making desal projects bankable, scalable, and sustainable. 🌊🏗️📉