Project Overview

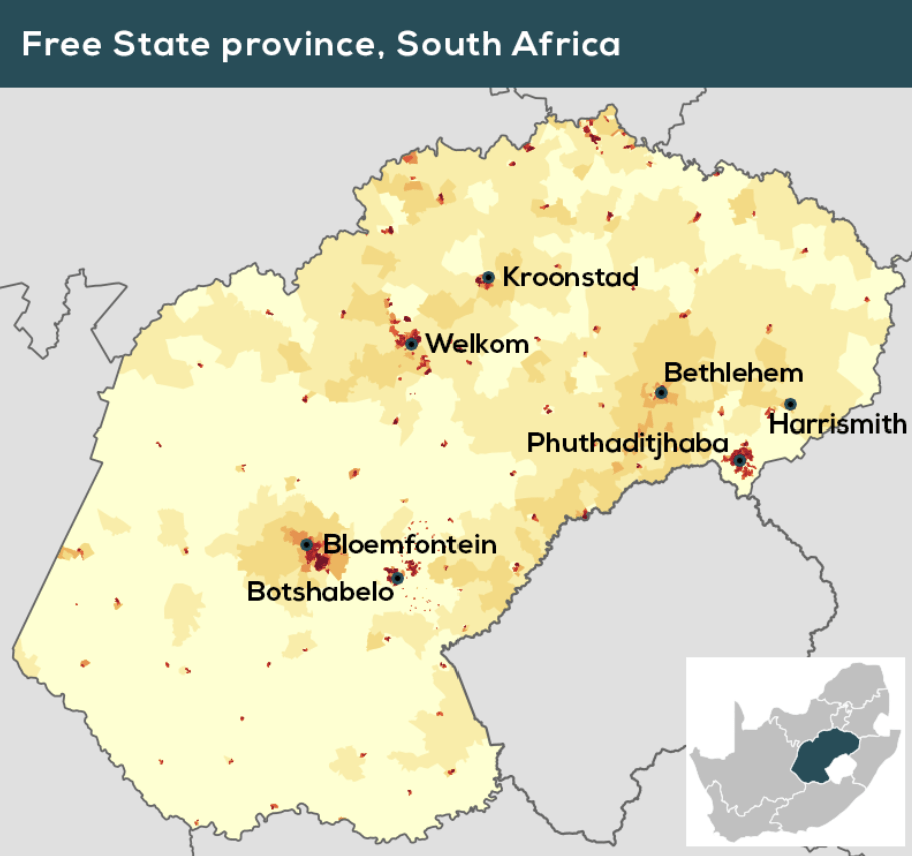

Scatec ASA has been named preferred bidder for the Kroonstad PV Cluster, totaling 846 MW, under South Africa’s REIPPPP Bid Window 7. The cluster includes two 293 MW plants (Oslaagte Solar 2 & 3) and the 260 MW Leeuwspruit Solar in the Free State province.

Financing & Ownership Structure

- Total capex: ZAR 13 billion (~US $735 million).

- Financing mix: up to 90% non‑recourse project finance; equity makes up the remainder.

- Equity split: Scatec (50.90%), Stanlib Greenstreet/Redstreet (46.50%), and a Community Trust (2.6%).

Strategic Context

- This award reflects South Africa’s strategic shift: reallocating initially earmarked wind capacity (3.2 GW) to solar, due to cost competitiveness and lower wind bid success.

- Free State, a high‑irradiance region on the Highveld plateau, is well‑suited to utility‑scale PV deployment.

Scatec’s Track Record

- Globally, Scatec develops, builds, owns, and operates renewable energy projects totaling ~6.2 GW.

- In South Africa, it has led major projects including Kenhardt (540 MW solar + 225 MW storage) and numerous earlier REIPPPP solar plants.

Financial Modelling Implications 📊

- IRR & NPV analysis: High solar resource yields strong revenues under 20‑year PPAs, supporting IRRs (8–12%) depending on cost of capital.

- Debt structuring: With debt at ~90%, financial models must stress-test DSCR under variable interest rate scenarios.

- Equity returns: Post-debt cash flows support equity IRR, affected by currency assumptions (ZAR/USD), inflation, and tax credits.

- Sensitivity analysis: Key risk factors include PPA price variability, irradiance fluctuations, and grid availability.

ESG & Local Impact 🌱

- Achieves >46% Black Economic Empowerment equity and community trust ownership, aligning with REIPPPP policy targets.

- Job creation, enterprise development, and skills initiatives are integral to socio-economic frameworks.

- Emissions avoided over life: estimated ~1 Mt CO₂ equivalent, bolstering South Africa’s Paris Agreement targets.

Next Milestones

- Financial close expected in 2026, with EPC, O&M, and asset management provided by Scatec.

- Construction to follow, accelerating rollout as part of SA’s broader renewable energy goals.

Conclusion

The Kroonstad PV Cluster not only expands Scatec’s African footprint but also exemplifies how utility‑scale solar is outperforming wind in cost and delivery. For financial modellers, it’s a compelling case of capital structure optimization, long‑dated revenue certainty, and embedded ESG benefits. South Africa’s pivot toward PV underscores a broader global trend—where solar, backed by robust modelling and local stakeholder alignment, is powering the energy transition.

🔍 Interested in financial modelling templates for solar PV?

Explore the Finteam Solar PV Model Template on Eloquens for a head-start on NPV, IRR, debt sizing, and scenario analysis ➡️ https://www.eloquens.com/tool/gyxxIMgg/finance/solar-project-financial-modeling/uk-solar-pv-excel-model

Curious to dive deeper into project-level cash flow structures, community impact layers, or bankability metrics? Let’s connect!