What Is a Waste-to-Energy Financial Model and Why It Matters 🌍♻️📈

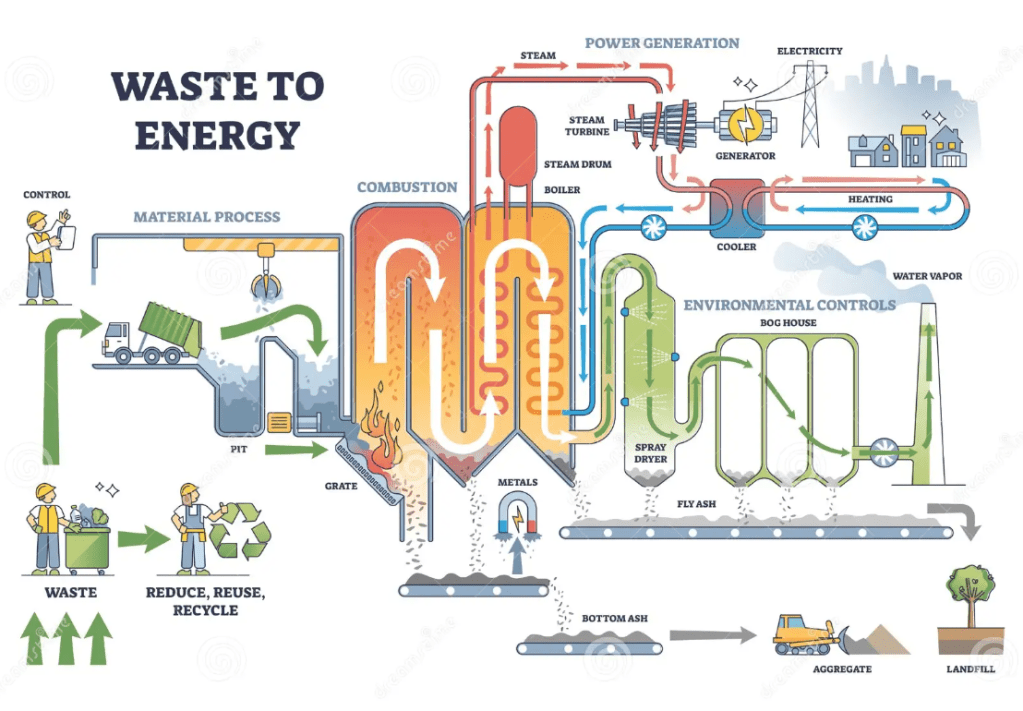

A waste-to-energy financial model is a crucial tool for assessing the viability of converting municipal solid waste (MSW) into electricity or heat. These WtE projects bridge environmental sustainability and renewable power generation. But their financial complexity—spanning multiple revenue sources and regulatory considerations—makes expert modeling essential. ♻️💼⚙️

Unlike traditional renewables, WtE plants benefit from dual revenue streams: 🌐💰📥

- Tipping Fees: Paid by municipalities or waste suppliers per ton of waste processed.

- Energy Sales: Derived from selling electricity or steam to utilities or industrial clients.

Building a financial model that accurately captures these cash flows and risks is key to investor confidence and lender support. 📊🔍🧩

Core Components of a Financial Model for Waste-to-Energy Projects 🧮📘🔧

a. Key Input Assumptions

- Annual waste throughput (tons/year)

- Tipping fee assumptions (€/ton or $/ton)

- Plant efficiency and energy yield per ton

- Electricity output (kWh/ton)

- PPA tariff or merchant market pricing

- CAPEX/OPEX benchmarks

- Plant lifespan (typically 20–25 years)

b. Waste-to-Energy Revenue Streams

- Tipping Fee Revenue = Volume × Fee

- Energy Revenue = Output × Power Tariff

c. Operating Cost Structure

- Fixed and variable O&M

- Residue disposal and treatment

- Labor, insurance, maintenance

- Feedstock quality penalties

d. Project Finance Terms

- Debt/equity structure

- Interest rate, tenor, grace period

- DSRA (Debt Service Reserve Account) 📉📈📘

e. Output Metrics for Investors

- Project IRR (levered/unlevered)

- NPV and payback period

- DSCR calculation (monthly and annual)

- Equity return waterfall

Advanced Financial Modeling Features for WtE Projects 🔬⚙️📏

To boost precision, include these elements in your WtE plant financial model:

Monthly Waste Inflows 📆♻️🔁

Model seasonal waste patterns to improve DSCR forecasting.

Degradation Modeling 📉🔧📊

Factor in annual performance loss (e.g., -0.5%/year).

Residual Waste Handling 🚮💸📦

Account for costs related to ash, scrap metals, or unburned waste.

Thermal Efficiency Sensitivity ⚡📊📐

Run IRR/NPV scenarios for 70%, 75%, and 80% conversion.

Revenue Mix Scenarios 🔁📈⚙️

Include toggles for PPA vs merchant electricity, and static vs indexed tipping fees.

Sample Output: Waste-to-Energy Model Case Study 📊📋🔍

| Metric | Value |

|---|---|

| Waste Throughput | 200,000 tons/year |

| Tipping Fee | €35/ton |

| Electricity Output | 700 kWh/ton |

| Power Tariff | €0.08/kWh |

| Total CAPEX | €95 million |

| O&M Costs | €10/ton |

| Project IRR (Unlevered) | 11.2% |

| DSCR (Avg) | 1.35x |

This benchmark reflects common economics for mid-size EU WtE projects. 🇪🇺♻️💡

Common Pitfalls in Waste-to-Energy Modeling 🚧🛑📉📛

Avoid these errors in your biogas or WtE model:

- Ignoring long-term waste supply risk

- Overestimating future tipping fees

- Underestimating capital expenditure

- Omitting emissions pricing or carbon tax impacts

A Financial Modeller’s View: Stress Testing for Bankability 👓📈🧠

Your job as a modeller is to build for uncertainty. A solid WtE model must:

- Toggle feedstock shortfalls

- Stress-test DSCR and IRR under yield volatility

- Separate waste and energy cash flows clearly

- Document assumptions with traceability 📂🔍📌

Recommended Waste-to-Energy Financial Model Template 🧾🔚📘

If you’re developing or reviewing a financial model for a biogas or waste-to-energy plant, consider using a prebuilt professional tool to accelerate quality and clarity.

✅ Biogas Waste to Energy Project Finance Model on Eloquens – includes:

- Full financial statements

- Valuation (NPV, IRR, payback)

- Debt/equity structuring

- Sensitivities & scenarios

Conclusion: Build Models that Deliver Results 🌍🛠️📈

Waste-to-energy projects are critical to circular economy and decarbonization efforts. But their success depends on solid financial modeling—where dual revenue streams, technical performance, and long-term contracts must be accurately forecasted.

The better your model, the better your financing. Let’s build smarter, cleaner infrastructure with financial rigor. 📩🤝📘