Overview: A Milestone for Renewable Energy in West Africa ⚡🌍📈

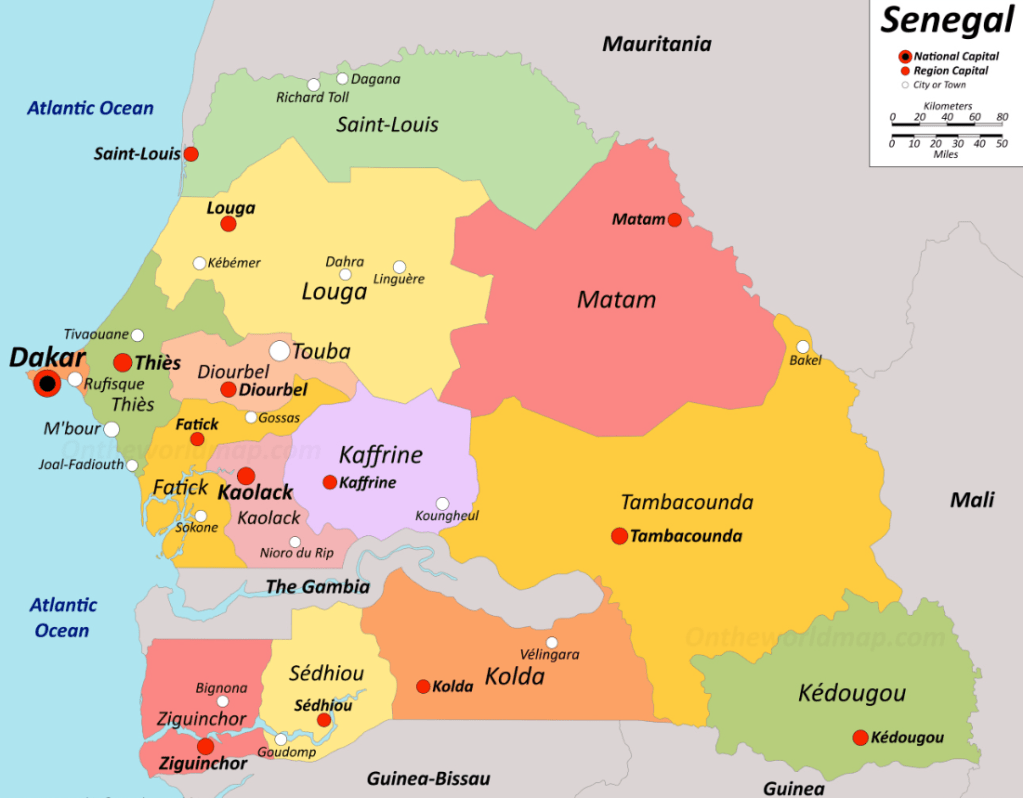

Energy Resources Senegal (ERS), through its subsidiary Teranga Niakhar Storage (TNS), has successfully secured financing for the Niakhar Solar + Storage project, a 30 MW photovoltaic plant coupled with a 15 MW / 45 MWh battery energy storage system (BESS) in Senegal’s Fatick region. This development represents a critical step forward for energy access and grid resilience in the region. 🌞⚡🛠️

The project, valued at XOF 36.25 billion (USD 64.3 million), is financed primarily through African institutions, highlighting a growing trend of regional capacity to lead complex renewable infrastructure projects. 🌍💼📊

Financing Structure: African Banks Lead the Way 💰🏦📈

Approximately 75% of the project cost is being financed by a syndicate of West African lenders:

- West African Development Bank (BOAD)

- International Bank for Commerce and Industry of Senegal (BICIS)

- Coris Bank International Togo (CBI Togo)

ERS is contributing XOF 9 billion (USD 16.07 million) in equity, of which XOF 5.4 billion (USD 9.64 million) is backed by an Islamic finance instrument, Murabaha Tawarruq, from the Islamic Bank of Senegal. This financing blend showcases innovative structuring and the use of Sharia-compliant tools to mobilize local capital for infrastructure. 🕌📑📊

Construction & Technology 🏗️🔋☀️

Construction has been awarded to a Chinese EPC consortium consisting of Zhejiang Electric Power Design Institute (ZEPDI) and APCC. Huawei Technologies is supplying the BESS, while JA Solar is the provider of the PV modules. 🏭🔧🇨🇳

Once operational, the Niakhar plant will:

- Generate 63.24 GWh annually

- Reduce CO2 emissions by 32,000 tonnes/year

- Supply over 150,000 residents with clean electricity

Senelec, Senegal’s national utility and 49% shareholder in ERS, will act as the offtaker under a 25-year PPA, guaranteed by the State of Senegal. ⚖️🔌🤝

A Financial Modeller’s Perspective 📊🧮📉

From a financial modelling standpoint, this project offers a fascinating case study in hybrid renewable project structuring: 💻📆📚

- Revenue Streams: The base case assumes income from the long-term PPA. However, potential ancillary services from the BESS (frequency regulation, load shifting) could add supplementary revenue layers. These should be stress-tested in any model scenario.

- Capacity Factor & Battery Dispatch: With a forecasted output of 63.24 GWh/year, assumptions about solar irradiance, panel degradation, and battery round-trip efficiency are central to the cash flow forecast.

- Debt Structuring: The CFA-denominated debt significantly reduces currency mismatch risks. Interest rates, tenors, and grace periods will heavily influence the debt service coverage ratio (DSCR).

- Islamic Finance Component: The inclusion of Murabaha Tawarruq introduces specific repayment structures. These must be modelled differently than conventional interest-bearing debt.

For those interested in building or benchmarking financial models for similar projects, especially solar PV with storage, a template is available here: Finteam Solar PV Model Template on Eloquens 📂📈🧩

Strategic Importance: Designed by Africa, for Africa 🌍🎯🇸🇳

This project stands out not only for its technical design but for its leadership by African stakeholders. Every key player—developer, equity investor, lender, and offtaker—is African. This marks a critical precedent in energy project development, reducing reliance on foreign currency-denominated debt and building financial and technical sovereignty. 💪🏾💡📢

Niakhar’s solar-storage hybrid model could serve as a replicable blueprint across Sub-Saharan Africa, particularly in countries seeking to enhance grid reliability without increasing fossil fuel dependency. 🧭📌🔋

Looking Forward 🌱📅🚀

Senegal has set ambitious goals to reach 2.5 GW of installed capacity by 2030. With projects like Niakhar, the country is on a viable path toward meeting that target sustainably and equitably. For developers, funders, and governments across the region, this project demonstrates how local innovation and capital can power the continent’s clean energy transition. 🔋🌄📈

As more renewable projects integrate storage, the complexity—and opportunity—for robust financial modelling grows. Tools, frameworks, and structured models will be crucial to ensure these projects are not just bankable but scalable. 📉🛠️🧠

For financial modellers, project developers, and energy investors tracking the West African market, Niakhar is one to watch. 👀📍💼