Copenhagen Infrastructure Partners’ (CIP) Mulilo Energy Holdings has closed a landmark ZAR 7 billion (EUR 340 million) equity holdco facility with Standard Bank, marking one of the largest commitments to South Africa’s renewable energy and battery storage sector to date. This transaction underscores both investor confidence and the strategic importance of energy transition in South Africa’s evolving power landscape. ⚡📊🌱

A Strategic Boost for South Africa’s Energy Transition 🌍⚡🔋

South Africa faces persistent challenges in electricity supply, with load shedding affecting industries and households alike. Mulilo’s expanded pipeline, supported by this financing, directly addresses these challenges by accelerating deployment of: 🌱📈⚡

- Renewable Energy Projects under the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP).

- Battery Energy Storage Systems (BESS), providing grid stability and enhancing integration of intermittent renewables.

- Private Off-take Agreements, aligning with a growing market for energy traders and aggregators outside of Eskom’s traditional monopoly.

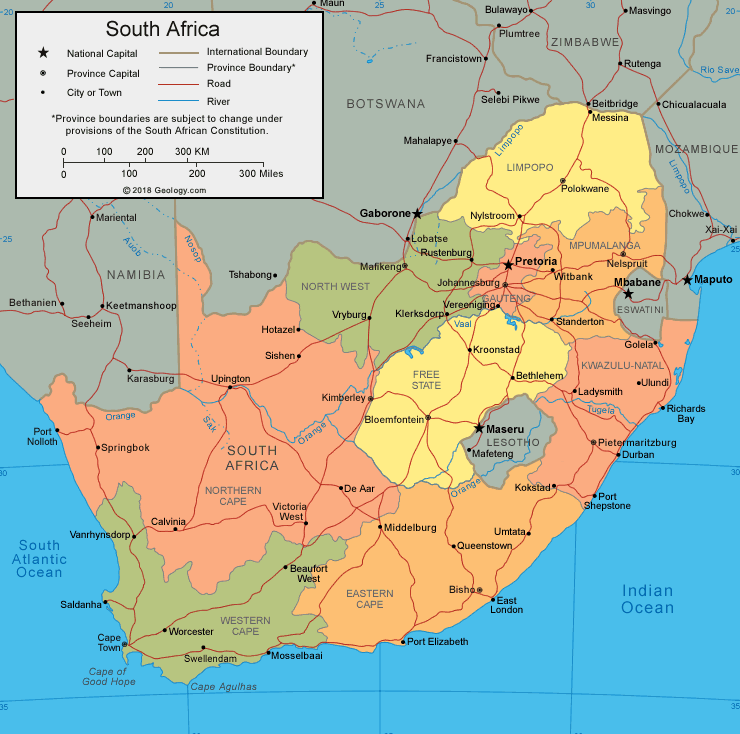

Earlier in 2025, Mulilo secured preferred bidder status for a 493 MW / 1.97 GWh battery storage project in Free State province. Beyond this, the company is progressing nine additional large-scale projects towards financial close. 🚀🔋🌍

Financial Modelling & Bankability 📊⚡🌱

For a facility of this magnitude, financial modelling is central to ensuring robust returns while managing risks unique to South Africa: 💡📈🔎

- Revenue Stream Forecasting: Accurate modelling of power purchase agreements (PPAs) under REIPPPP versus merchant or private off-take contracts. The variance in tariffs and counterparty risks requires scenario-based sensitivity analysis.

- Debt Structuring: Equity holdco facilities like this one play a pivotal role in optimizing capital structure—layering project-level debt with corporate-level equity to balance liquidity and leverage.

- Storage Economics: Battery projects rely on capturing value from arbitrage (charging at low tariff, discharging at peak), ancillary services, and capacity payments. Modelling dispatch strategies and degradation curves over 15–20 years is key.

- FX and Inflation Risks: With ZAR volatility and inflationary pressures, financial models must stress-test exchange rates, escalation indices, and cost pass-throughs.

For financial modellers and project developers, tools such as the Battery Energy Storage System (BESS) 10-Year Financial Model provide templates for structuring debt/equity scenarios, IRR calculations, and project risk assessments in renewable portfolios. 📊🌍🔋

Why This Matters 🚀🌍⚡

The Mulilo–Standard Bank partnership is more than just financing—it represents a template for future large-scale renewable and storage investments in South Africa: 🌱📈🔋

- Grid Impact: Strengthening grid stability by integrating nearly 2 GWh of battery capacity.

- Economic Growth: Mobilizing billions in investment, creating construction jobs, and fostering local supply chains.

- Investor Confidence: Validating South Africa’s renewable sector as investable, despite policy and grid constraints.

- Replication Potential: Establishing scalable frameworks for independent power producers (IPPs) engaging in both public tenders and private PPAs.

Looking Ahead 🔮⚡🌱

With nine large-scale projects advancing towards financial close and a flagship BESS project under development, Mulilo is positioning itself as a leading player in South Africa’s energy transition. The ZAR 7 billion facility sets a precedent for structuring equity-backed pipelines in emerging markets, blending financial innovation with technical expertise. 📊🌍🚀

As South Africa accelerates toward a more resilient, low-carbon grid, this transaction demonstrates the pivotal role of financial modelling, innovative structuring, and institutional partnerships in bridging ambition with execution. 🌱⚡🔋

🌱 Final Thought: For investors, developers, and financial modellers, the Mulilo deal underscores a clear message: South Africa’s renewable and storage market is not just growing—it’s bankable and ready to scale. 🚀📊🌍