On September 26, 2025, S&P Global Ratings upgraded Morocco’s long- and short-term sovereign credit ratings to BBB-/A-3 from BB+/B, with a Stable Outlook. This marks a milestone in the country’s fiscal and economic trajectory: Morocco is now officially investment grade. ✨ For financial modelers, infrastructure investors, and renewable energy developers, this upgrade reshapes the risk-return dynamics of Moroccan projects.

Macroeconomic Fundamentals Driving the Upgrade 📊

S&P based its decision on Morocco’s sound macroeconomic policies and structural reforms:

- Growth Outlook: Real GDP growth is forecast to average 4% annually from 2025–2028.

- Fiscal Consolidation: Budget deficits are projected to narrow to 3% of GDP by 2026, driven by tax reforms and reduced subsidies.

- Debt Stabilization: General government debt-to-GDP is expected to fall below 60% by 2028, with interest payments contained at ~7% of revenues.

- External Buffers: FX reserves cover 5.5 months of imports, bolstered by steady FDI inflows and strong export performance in automotive, aerospace, phosphates, and tourism.

For modelers, these parameters improve project bankability assumptions. Lower sovereign risk premiums reduce the discount rate applied in NPV (Net Present Value) calculations, improving valuations across sectors. 💰

Structural Reforms & Diversification 🌱

Morocco’s upgrade reflects ongoing reforms designed to formalize the economy and broaden the tax base:

- Launch of a unified social security registry and expansion of healthcare coverage.

- Tax reforms simplifying VAT, income tax, and corporate tax structures.

- Investments in water security, including desalination, recycling plants, and north–south transfer programs to mitigate drought risks.

These reforms enhance the long-term stability of cash flows in infrastructure and renewable energy projects. From a financial modeling standpoint, improved fiscal predictability lowers scenario volatility in debt service coverage ratios (DSCRs). 📑

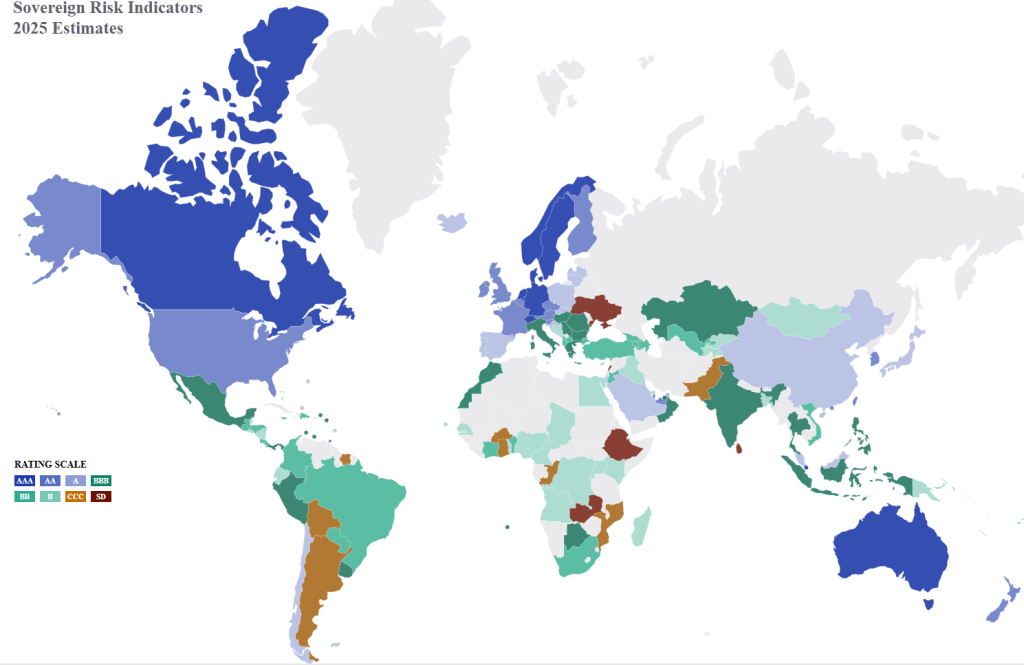

Investment‑Grade in Africa: A Rare Status 🏅

With this upgrade, Morocco joins a very small group of African countries rated investment grade. Currently, only Botswana and Mauritius share this status on the continent. Morocco is now the third investment‑grade sovereign in Africa, highlighting its growing economic resilience and attractiveness for global investors. 🌍

This rarity underscores the significance of Morocco’s achievement. For investors, the country now offers a safer harbor in a region where sovereign risk is often priced much higher.

Investment Implications for Renewable Energy ⚡

Morocco is positioning itself as a regional hub for green energy, leveraging its geographic location and policy reforms. For renewable energy developers, the S&P upgrade has several consequences:

- Cost of Capital: A BBB- rating improves access to cheaper international financing. Investors can lower the weighted average cost of capital (WACC) in project finance models.

- Risk Allocation: Political and currency risks remain, but the rating upgrade allows for stronger structuring of PPAs (Power Purchase Agreements) with international lenders.

- Investor Appetite: With Morocco co-hosting the FIFA 2030 World Cup, infrastructure pipelines (energy, transport, water) will likely attract global capital.

Risks to Monitor ⚠️

Despite the positive trajectory, risks remain:

- Climate Vulnerability: Agriculture (10% of GDP, 25% of employment) is still exposed to drought cycles.

- Youth Unemployment: At ~13%, job creation lags behind economic growth.

- Geopolitical Dependence: Heavy reliance on European markets (notably Spain its main export market) for exports exposes Morocco to external shocks.

For modelers, this means running sensitivity analyses on commodity prices, rainfall variability, and Eurozone demand remains crucial. 🔎

Conclusion 🚀

Morocco’s upgrade to investment grade is a transformative signal for international investors and renewable energy financiers. With stronger fiscal buffers, structural reforms, and robust export growth, the country is entering a phase where project finance structures can be optimized with lower risk premiums.

For financial modelers, this upgrade is more than a credit rating—it is a shift in the baseline assumptions of discount rates, debt structuring, and investor appetite for Moroccan renewable projects. The opportunities ahead are significant, provided risks are adequately stress-tested.