Norwegian development finance institution Norfund announced that it has signed an agreement to sell its 50.1% stake in Klinchenberg BV—a joint venture holding indirect stakes in several African hydropower assets—to UK-based Savannah Energy for up to USD 65.4 million. British International Investment (BII), the UK’s development finance institution, retains the remaining 49.9% stake. 💼🌍🔑

The portfolio includes some of Africa’s most strategic hydropower assets:

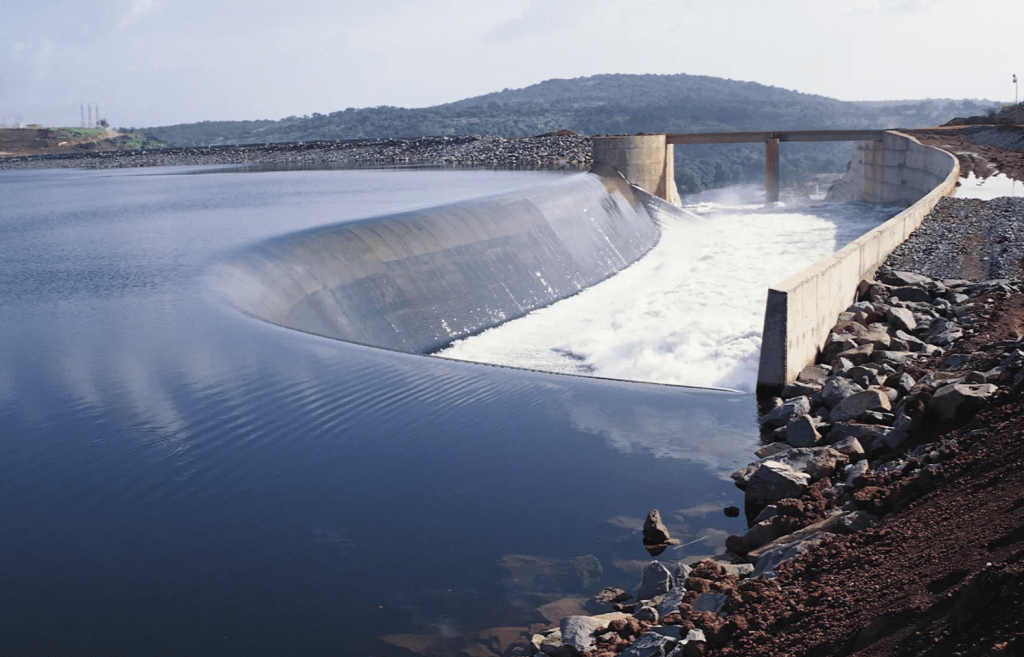

- Bujagali, Uganda – 255 MW run-of-river hydropower plant (operational)

- Mpatamanga, Malawi – 361 MW hydropower development project

- Ruzizi III, Burundi/DRC/Rwanda – 206 MW regional hydropower project

Collectively, these projects represent 822 MW of clean energy capacity, critical to regional electrification and cross-border energy cooperation. ⚡🌍🌱

Transaction Details 📝💰🔒

Savannah Energy will acquire Norfund’s stake for up to USD 65.4m, financed by:

- USD 37.4m debt facility from an undisclosed international bank.

- Existing company cash reserves.

The deal includes:

- USD 6.8m deferred cash element, payable three years post-completion.

- Contingent payments tied to the financial close of the Mpatamanga and Ruzizi III projects.

Completion is expected no earlier than Q1 2026, with an economic effective date of 31 December 2024. 📆🏦🌐

Financial Modeling Considerations 📊 💡📑🔍

For investors and developers, hydropower projects of this scale involve complex financial structuring:

- Revenue Forecasting: Long-term PPAs underpin stable revenues, but hydrological variability requires robust sensitivity modeling.

- Contingent Liabilities: Future cash outflows linked to project milestones (e.g., Mpatamanga financial close) affect valuation models.

- Debt Structuring: Savannah’s mix of new debt and internal cash reserves highlights the need for careful leverage calibration to avoid overexposure while maintaining attractive equity returns.

- Valuation Metrics: Internal Rate of Return (IRR) analysis must incorporate deferred payments and project completion risks. Hydropower assets in Africa often target equity IRRs in the 12–16% range, depending on offtake risk and political stability.

Analysts typically stress-test Debt Service Coverage Ratios (DSCRs) under different rainfall and hydrology assumptions. This ensures resilience against variability in generation, which directly impacts cash flow stability. 🌧️💧📈

Strategic Importance for Savannah Energy 🌟🔋🌍

This acquisition aligns with Savannah Energy’s strategy of investing in “Projects that Matter” across Africa. By entering hydropower, Savannah diversifies its renewable energy portfolio beyond its existing gas and solar projects. Importantly, the Klinchenberg assets are regionally distributed, enhancing resilience and strategic positioning:

- Uganda’s Bujagali already supplies a significant portion of the country’s electricity.

- Mpatamanga and Ruzizi III, once operational, will contribute to regional power trade and reduce reliance on fossil fuels. 🌐⚡🏭

ESG and Development Impact 🌱 🌍🤝💡

Hydropower remains central to Africa’s energy transition, offering low-carbon baseload generation that complements intermittent renewables like solar and wind. Key ESG contributions include:

- Environmental: Avoided CO₂ emissions through large-scale renewable capacity.

- Social: Expanding electricity access for millions in East and Southern Africa.

- Governance: Structured partnerships between DFIs (Norfund, BII) and private sector players (Savannah Energy). 🌱⚖️🌍

Looking Ahead 🔭📌🌐

The transaction illustrates a broader trend: development finance institutions (DFIs) exiting mature assets to recycle capital into new frontier projects, while private investors scale operations. For Savannah Energy, the acquisition is both a growth opportunity and a test of its capacity to manage large, multi-jurisdictional hydropower projects. 📊📉🚀

For financial modelers, the deal underscores the importance of:

- Integrating contingent payment structures into valuation models.

- Assessing cross-border regulatory and political risks.

- Modeling portfolio diversification benefits when assets are spread across multiple regions. 🧮🌍📘

Conclusion 🏁📢✅

Norfund’s exit and Savannah Energy’s entry mark a significant shift in Africa’s hydropower investment landscape. With over 800 MW of clean energy capacity at stake, this transaction will shape regional power dynamics, deepen private sector involvement, and provide a new benchmark for structuring hydropower investments in emerging markets. 🌊⚡🌍