On 1 October 2025, Red Rocket, a South African independent power producer (IPP) backed by STOA, Inspired Evolution, and FMO, announced it has reached financial close for the 331 MWp Tournee Solar Park in Mpumalanga. The milestone follows the signing of a 20-year Power Purchase Agreement (PPA) with Discovery Green, the renewable energy arm of insurer Discovery. ☀️📊🌱

Project Overview 📊⚡🌍

- Capacity: 331 MWp (300 MW contracted)

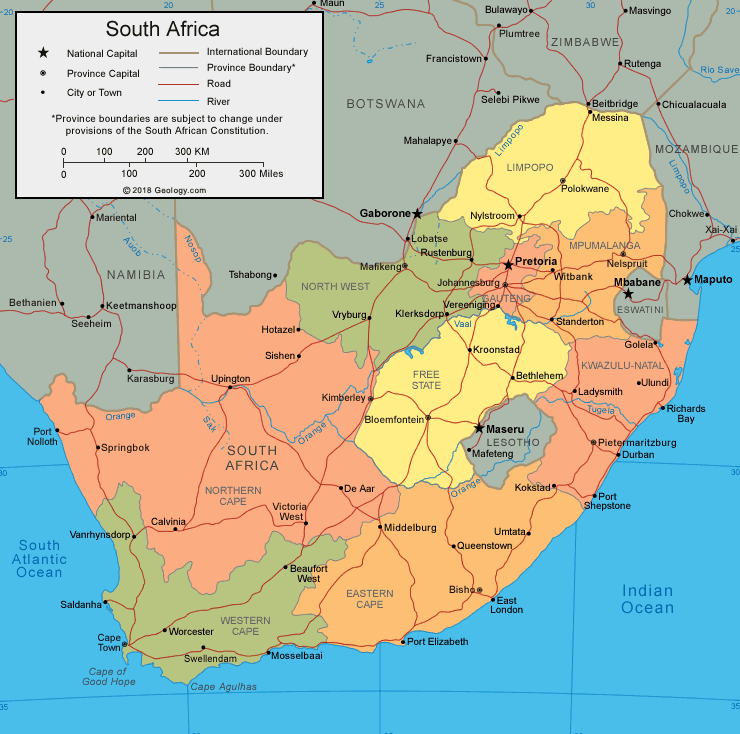

- Location: Mpumalanga, South Africa

- Technology: ~463,000 bifacial modules on single-axis trackers

- Grid Connection: 132kV overhead powerline

- Annual Generation: ~720 GWh

- CO₂ Avoided: ~709,200 tonnes per year

- Homes Powered: Equivalent of ~224,000 households

- Commercial Operation Date: 2027

The Tournee Solar Park will become South Africa’s second-largest solar PV project, solidifying Red Rocket’s position as a leading developer in the region’s renewable energy landscape. ⚡🌍📈

Financing & Structure 💰📊🌱

The project’s financing was arranged through a club deal involving:

- Absa Corporate & Investment Banking (Absa CIB), one of South Africa’s largest financial services groups, known for structuring large-scale infrastructure and renewable energy financings

- Standard Bank CIB

- Development Bank of Southern Africa (DBSA)

Equity partners include STOA, Inspired Evolution, FMO, and the Red Rocket Opportunity Trust as a Broad-Based Black Economic Empowerment (BEE) partner, a structure designed to promote inclusive participation of historically disadvantaged South Africans in major projects. The combination of local commercial banks with development finance institutions demonstrates the appetite for large-scale renewables in South Africa, particularly under the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) framework, South Africa’s flagship competitive bidding process designed to attract private sector investment into renewable energy through transparent auctions and long-term PPAs. 💡⚡🌍

Financial Modelling Considerations 🧮📊⚡

Large-scale projects such as Tournee Solar Park involve complex modelling to ensure bankability: 🌍💼📉

- Revenue Stability: A 20-year PPA with Discovery Green underpins predictable cash flows, a crucial factor in debt structuring.

- Capacity Factor Assumptions: With bifacial modules and single-axis tracking, modellers will project higher performance ratios compared to fixed-tilt systems. Expected capacity factors could range between 27–30%, depending on irradiance levels in Mpumalanga.

- DSCR & Debt Structuring: Lenders will likely structure debt with a tenor of 15–18 years, requiring robust cash flow waterfalls and sensitivity analysis to interest rates and tariff adjustments.

- Carbon Credits & ESG Integration: With ~709,200 tonnes of CO₂ avoided annually, analysts may integrate potential carbon credit revenues into their financial models, enhancing IRR projections.

- Equity IRR Outlook: With debt leverage and predictable revenue streams, equity IRR could range 12–15% under base case scenarios, with upside in case of performance gains or tariff escalations.

For analysts looking to replicate such modelling exercises, the Finteam Solar PV Model Template on Eloquens provides a comprehensive toolkit for assessing cash flows, IRRs, and sensitivities: Finteam Solar PV Model Template. 📊📈💡

Strategic Importance 🌍⚡📊

South Africa’s REIPPPP Round 7 has reaffirmed the country’s position as one of Africa’s leading renewable energy markets. With grid constraints in Mpumalanga — historically the hub of coal generation — large-scale solar projects represent both an economic transition and a climate resilience measure. ☀️🌱⚡

The Tournee project directly supports South Africa’s Integrated Resource Plan (IRP) targets, ensuring a gradual decarbonisation of the national grid while fostering local job creation and industrial development. 📈🌍💼

ESG Impact 🌱⚡🌍

- Environmental: Significant reduction in CO₂ emissions, diversifying away from coal-heavy Mpumalanga.

- Social: Thousands of jobs during construction and long-term operations.

- Governance: Strong participation from local financial institutions and BEE partnerships ensures equitable growth.

Conclusion ⚡🌍📊

The financial close of the Tournee Solar Park signals a strong vote of confidence in South Africa’s renewable energy sector. By combining robust financing structures, innovative technology, and long-term PPAs, Red Rocket is setting a new standard for solar investments in Africa. ☀️💡🌱

📩 For financiers, analysts, and developers, Tournee Solar Park highlights the critical role of financial modelling in project bankability. 📊⚡🌍