Al Mana Holding, the Qatar-based diversified conglomerate, has agreed to invest USD 200 million in a sustainable aviation fuel (SAF) production facility in Egypt’s Suez Canal Economic Zone (SCZONE). The project represents Al Mana’s first industrial investment in the SCZONE and a major step in positioning Egypt as a regional hub for low-carbon aviation fuels. 🇪🇬🛢️🌱

Project Overview: Scaling SAF Production in Sokhna 🏗️✈️⚡

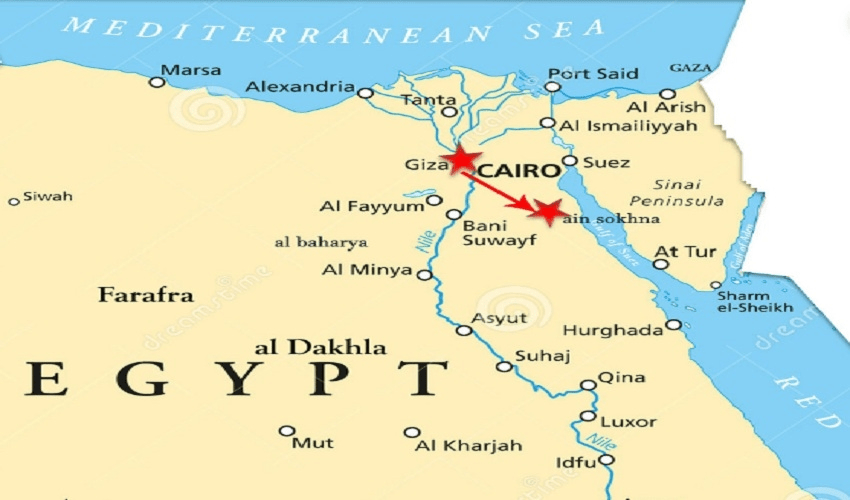

The project will be developed through a dedicated special purpose vehicle, SAf Fly Limited, and will be located in the integrated Sokhna area, spanning 100,000 square metres across the industrial zone and Sokhna port.

Key project features include:

- Annual production capacity: 200,000 tonnes

- Products: Sustainable jet fuel (HVO), BioPropane, and BioNaphtha

- Feedstock: Used edible oils

- Targeted start of SAF supply: Late 2027

The facility is expected to reduce lifecycle greenhouse gas emissions by 50–80% compared to conventional jet fuel, aligning with global aviation decarbonisation targets. 🌍📉✈️

Bankability Anchored by Long-Term Offtake 📊🤝🛢️

A critical element underpinning the project’s bankability is a long-term offtake agreement with Shell, under which the global energy major has committed to purchase 100% of the plant’s output. This fully contracted revenue profile significantly de-risks demand and supports long-tenor financing structures.

From a project finance perspective, full offtake coverage is particularly important for SAF facilities, given feedstock price volatility, technology risk, and evolving regulatory frameworks across aviation markets. 📘📉⚙️

Strategic Importance for Egypt and the Suez Canal Economic Zone 🇪🇬🌍🏭

The SAF project strengthens the SCZONE’s positioning as a destination for energy transition and export-oriented industrial investments. With direct access to global shipping routes and aviation markets, Sokhna offers logistical advantages for SAF exports to Europe and beyond.

The investment also supports Egypt’s broader objectives to:

- Expand green fuel manufacturing

- Increase exports and reduce imports

- Attract Gulf strategic capital into industrial sectors

- Support the decarbonisation of the fast-growing aviation sector

The project was formally signed in the presence of Egypt’s Prime Minister, underscoring its national strategic importance. 🏛️📈🌱

Financial Modelling Perspective: SAF Project Economics 📊🧮✈️

For financial modellers, the project highlights several core SAF valuation drivers:

- Feedstock sourcing and pricing assumptions (used cooking oil availability)

- Conversion yields and technology efficiency

- Long-term offtake pricing mechanisms versus fossil jet fuel benchmarks

- Carbon intensity reductions and potential upside from SAF mandates or incentives

- Sensitivity to capex overruns and commissioning risk

With aviation SAF mandates tightening in Europe and other jurisdictions, projects with secured offtake and port-based logistics are increasingly attractive from a risk-adjusted return standpoint. 📉📈⚙️

Conclusion: A Flagship SAF Investment for the Region 🚀✈️🌍

Al Mana’s USD 200 million investment marks a significant milestone for SAF development in North Africa and the Middle East. Backed by a global offtaker and located at one of the world’s most strategic logistics corridors, the Sokhna SAF plant positions Egypt to play a growing role in the global aviation energy transition—while reinforcing cross-border investment ties between Qatar and Egypt. 🌱🤝📈