India-based KP Group’s agreement to invest USD 4 billion in Botswana’s renewable energy sector marks one of the most ambitious clean energy commitments ever announced in the country. Targeting nearly 5 GW of renewable generation capacity, alongside energy storage and high-voltage transmission infrastructure, the Memorandum of Understanding (MoU) aligns closely with Botswana’s ambition to reach net-zero emissions by 2030. 🇧🇼🌍🌱

Beyond scale, this announcement matters because it combines generation, grids, storage, and skills development into a single, integrated investment narrative—an approach increasingly favoured by financiers and development partners across Africa. 🌍📊⚡

Project Scope and Strategic Context ⚡📊🌍

The MoU, signed between KP Group and Botswana’s Ministry of Minerals and Energy, covers:

- ⚡🌞🇧🇼 Utility-scale renewable energy generation projects, expected to be predominantly solar PV given Botswana’s high irradiation levels.

- 🔋📊🌍 Energy storage systems to improve grid stability and dispatchability.

- 🌍⚡🇧🇼 Development and strengthening of high-voltage transmission infrastructure, including regional interconnections.

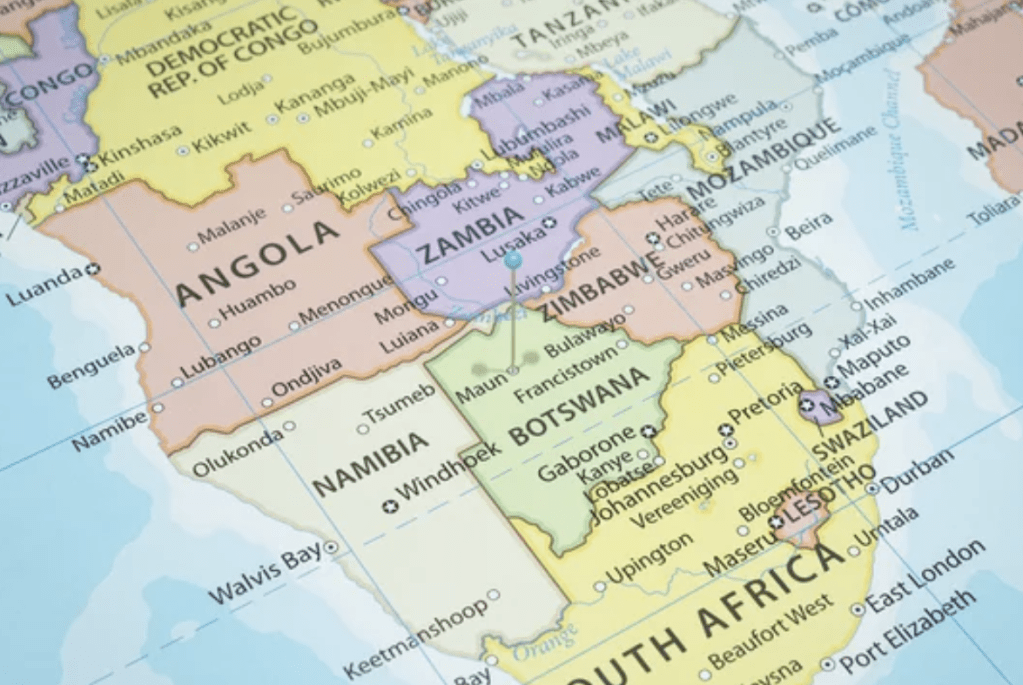

With Botswana historically reliant on coal and power imports from the Southern African Power Pool (SAPP), the addition of up to 5 GW of domestic clean capacity could materially shift the country’s energy balance. For context, Botswana’s current installed capacity is well below 1 GW, meaning this pipeline—if fully realised—would be transformational. 🇧🇼⚡📈

Transmission and Regional Integration 🌍⚡📊

One of the most compelling aspects of the MoU is its explicit focus on transmission. Large-scale renewables in Africa frequently face curtailment risks due to weak grid infrastructure. By bundling generation with high-voltage lines and regional interconnections, the KP Group–Botswana partnership addresses a core bankability challenge upfront. 🌍📉⚡

From a financial modelling perspective, integrated transmission investments can significantly:

- 📉⚡🌍 Reduce downside scenarios linked to grid congestion.

- 📊📈🌍 Improve long-term capacity factors.

- 🌍💰🇿🇦 Support cross-border power sales within SAPP, creating diversified revenue streams.

For lenders, this enhances forecast stability and can translate into tighter debt pricing and longer tenors. 📊📈⚡

Financial Modelling Considerations: What Will Matter for Bankability 📉📊⚡

A USD 4 billion, multi-technology programme will require sophisticated project and portfolio-level financial models. Key modelling assumptions likely to be scrutinised include: 📊📉⚡

- 📄💰🇧🇼 Tariff structures and PPAs: Whether projects rely on long-term government-backed PPAs, merchant exposure via SAPP, or hybrid structures.

- 💱📊🌍 IRR sensitivity: FX exposure, particularly if revenues are denominated in BWP while capex and debt are in USD.

- 🔋⚡🌍 Storage dispatch assumptions: Optimising battery sizing and cycling profiles to enhance peak pricing and grid services revenue.

- 🏗️📅🌍 Capex phasing: Staggered deployment over several years to manage construction risk and balance sheet exposure.

For solar-heavy portfolios, detailed hourly generation and degradation modelling becomes essential. Tools such as structured solar PV financial models—like this one commonly used by developers and lenders—are often applied to stress-test DSCRs and equity IRRs under different irradiation and curtailment scenarios: https://www.eloquens.com/tool/gyxxIMgg/finance/solar-project-financial-modeling/uk-solar-pv-excel-model?ref=finteam 📊🌞🇧🇼

ESG and Local Impact: Beyond Megawatts 🌱🌍📊

The partnership goes beyond infrastructure. KP Group’s commitment to offer 30 annual scholarships to Batswana citizens in renewable energy, engineering, and sustainability is a notable ESG lever. For DFIs and ESG-focused investors, such components strengthen the project’s social impact narrative and can be reflected in sustainability-linked financing frameworks. 🌱📘🇧🇼

From an ESG reporting standpoint, key measurable outcomes could include: 🌱📊🌍

- 👷🏽♂️🌍🇧🇼 Local employment during construction and operations.

- 🎓⚙️🇧🇼 Skills transfer and long-term workforce development.

- 🌱📉🌍 Emissions reductions relative to coal-based generation baselines.

Why This Deal Signals a Broader Trend 🚀🌍📈

KP Group’s move into Botswana reflects a wider trend of Indian renewable energy players expanding into African markets, leveraging experience in large-scale, cost-competitive solar and hybrid projects. With KP Group already managing around 6 GW in India and targeting 10 GW by 2030, Botswana could become a flagship international platform. 🇮🇳➡️🇧🇼🚀

If executed effectively, this USD 4 billion programme could redefine Botswana’s power sector, strengthen regional energy security, and set a benchmark for integrated renewable, storage, and transmission investments in Southern Africa. 🌍📈⚡